Did you know that around 20% of startups fail during the first year of operations?

Understanding the key stages of the business life cycle is essential to ensuring that your business avoids that fate.

It is important to identify at which stage of the business life cycle your enterprise is, because that will define the direction of your operations and inform your company’s strategic planning.

In this post, we will cover the evolutionary process of an average business, from the inception of the business idea to its decline, and explore how the business life cycle is different from business growth.

We will also identify examples and discuss the most important areas to focus on during each stage of the life cycle.

Let’s jump right in!

[ez-toc]

Work with our consultants. Request a quote

What Is A Business Life Cycle?

A business life cycle is a cyclical representation of the stages an average business goes through from seeding to decline and renewal.

This evolutionary overview helps entrepreneurs and leaders optimize growth through the key stages, increasing the value of their business.

Stages Of Business Life Cycle vs. Business Growth: How Are They Different?

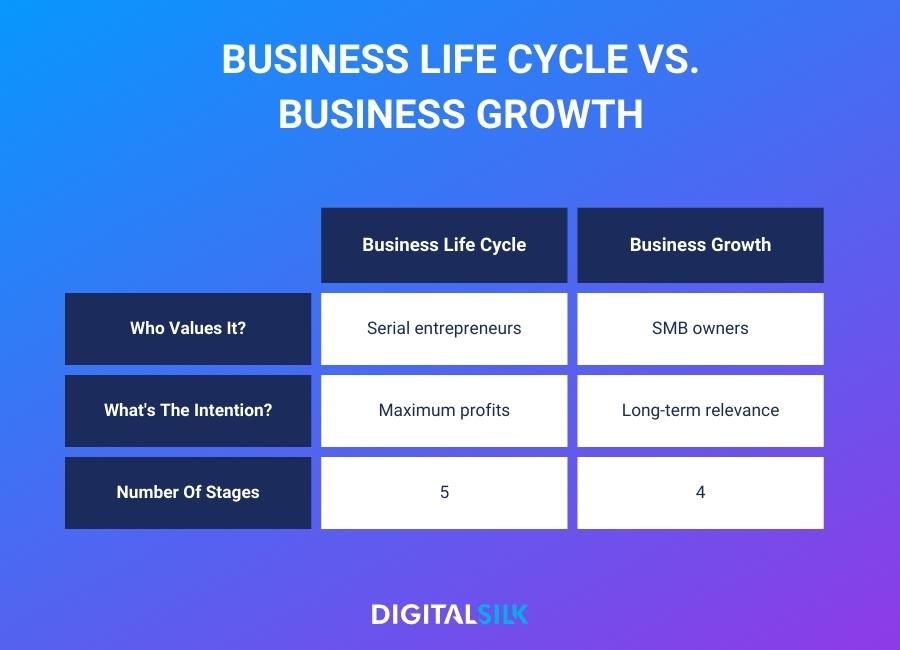

The main differences between the stages of a business life cycle and business growth are the way their stages are categorized and the way in which they are utilized.

While sometimes used interchangeably, these terms represent different takes on the evolution of a business, are used by different types of business owners and each have a distinct set of stages.

Take a look at the key differences between the two in the table below:

As shown above, a small and medium sized business owner will value and strive to achieve the four business growth stages: startup, growth, expansion and maturity. This is done in a bid to harness prolonged growth and keep their brand relevant for years to come.

Meanwhile, serial entrepreneurs will track the business life cycle as they aim to receive maximum profits for their business once it has reached its peak.

What Are The 5 Stages Of A Company Life Cycle?

The evolution of entrepreneurial ventures spans various phases, from planting the seeds of a business idea to reaching maturity and in some cases, decline.

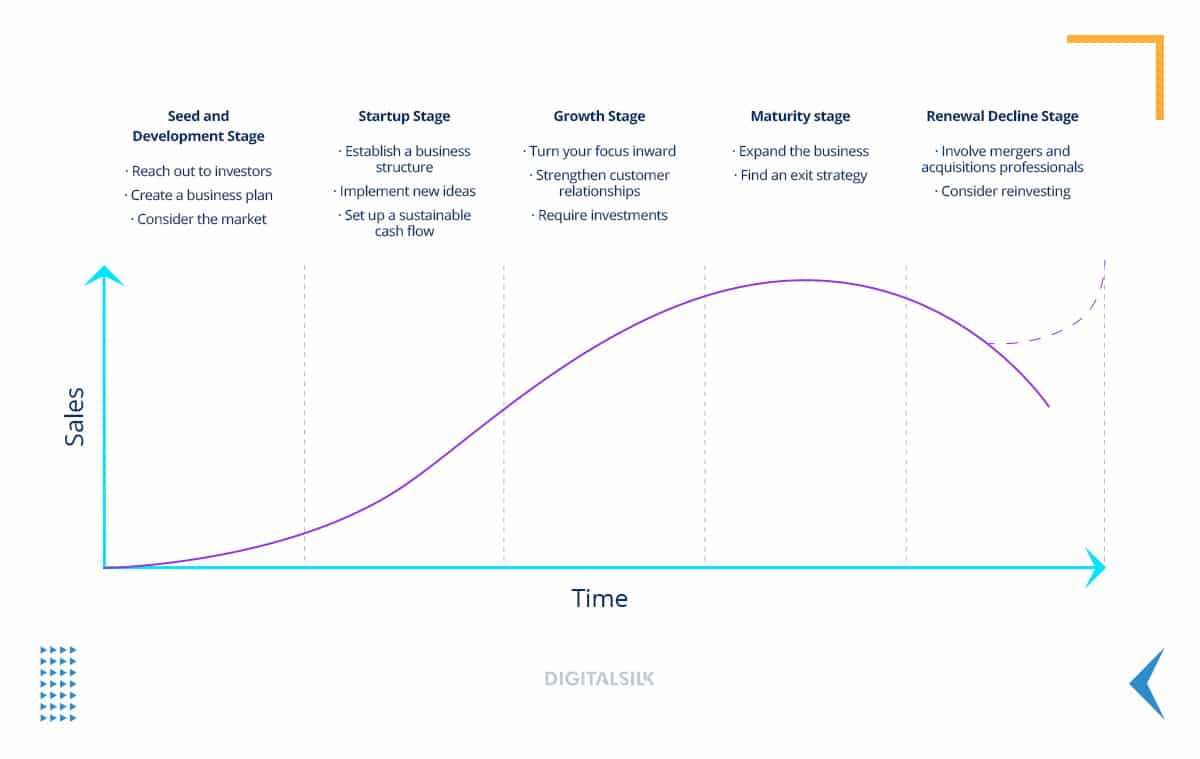

The five cyclical stages in a business’s existence are:

1. Seed & Development

Your business’s life cycle begins with an idea. Before your business has sprouted to life, you are ready to plant your business seed and nurture it to success.

Called the seed stage in reference to seed funding, it is during this phase that entrepreneurs search for the investors that will financially support their startup.

During this period, you’ll need to ask yourself whether your business idea will provide both short-term return-on-investment (ROI) and long-term profits.

Goal: Making an estimate of your idea’s business feasibility – that is, if it’s worth developing into an actual business.

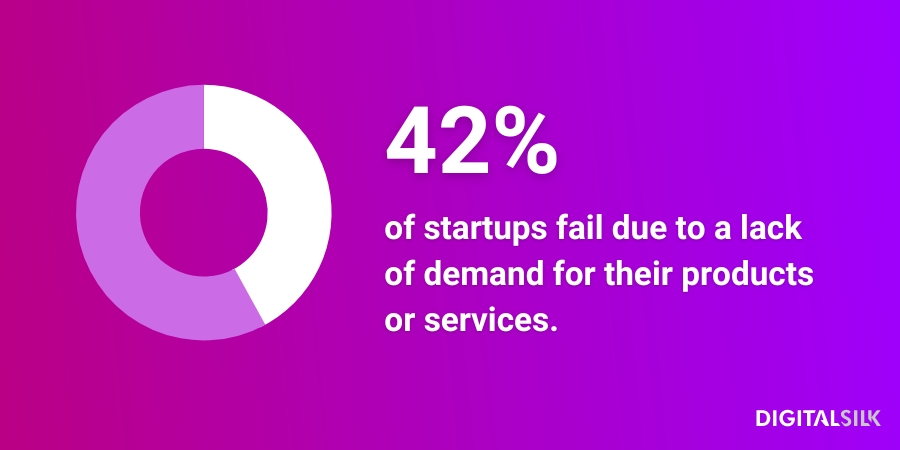

Challenge: 42% of startups fail due to a lack of demand for their products or services. As such, identifying and pursuing a market niche that offers sustainable demand is the main challenge at the seed stage.

What to focus on:

- Reach out to investors: Financial support at this stage is crucial, so try to find individuals or organizations that may be interested in your project enough to provide monetary assistance. This will involve a great deal of market and economic research to establish the project’s feasibility.

- Create a business plan: It is always important to analyze and firmly establish the strengths, weaknesses, opportunities and threats your business may encounter in the market you intend to enter. The financial foundation of your launch will be a large factor in the success of your business, so try to plan that as much as possible, to the very last detail.

- Garner advice and opinion from professionals: Experienced industry specialists and entrepreneurs you may have access to, as well as business associates, friends and colleagues who are competent in this regard, can provide valuable insight and opinions on the potential of your business idea. Inquire about their main takeaways from the seed funding stage of their own projects and the biggest obstacles they had to overcome.

- Consider the market and your role in it: Ask yourself if the market is ready to accept your business and if your concept, product, service or idea can fill an existing need in the market. How can your idea soothe the pain points of your prospective customers and clients?

2. Startup

At the startup stage of the business lifecycle, you’ll need funding from investors, banks or your own back pocket.

Regardless of where your funding comes from, extreme flexibility, adaptability and resourcefulness are your best friends at this stage. It’s a period of testing, failing and trying again.

The startup stage is usually marked by:

- Adapting your business model to the changing perspectives of the market and the feedback of your first customers

- Learning how to turn a profit

- Outlining your strategy and work processes

- Business formation and incorporation

Due to so many changes and alterations, you may feel a sense of confusion at this stage. Resist the urge to dwell on it, trust the process and power your way through: difficulties are natural at this stage and the path will be much clearer soon enough.

Goal: Making your business operational, sustainable and, most of all, profitable.

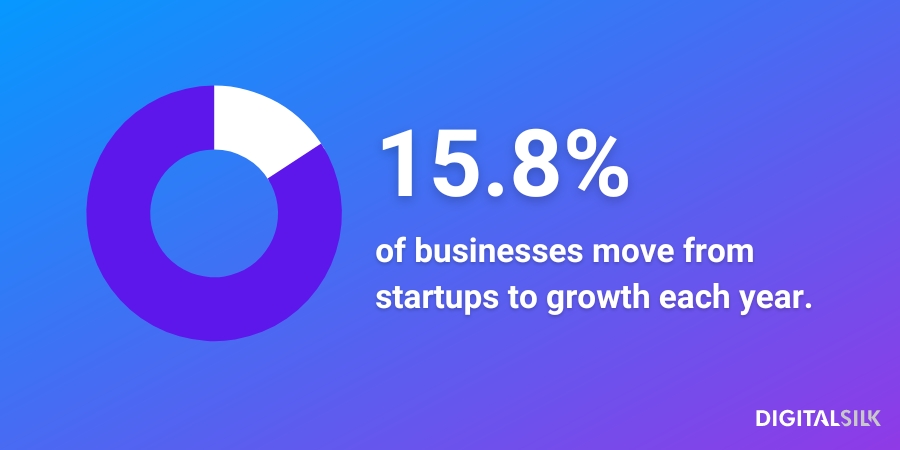

Challenge: Only 15.8% of businesses manage to move from the startup stage to the growth stage within a year. The main challenge of this stage is to develop a business model that will turn a profit, attract new customers and retain employees.

What to focus on:

- Establish a business structure: At the beginning of the startup stage, your employees are likely wearing many hats. Everybody does a little bit of everything, which is a prerogative for any new enterprise, but a corporate structure must exist in order for the company to keep growing beyond this phase.

- Consistently implement new ideas: During the startup phase, you spend your time meeting people and coming up with new ways to sell your products or services. Listening to customer feedback and trying new ideas will provide clarity on what aspect of your product(s) or service(s) to focus on in the future.

- Figure out a sustainable cash flow: This is the right time to come up with a business model that provides a consistent cash flow that will, in turn, provide consistent growth and the ability to retain old employees and hire new ones.

- Face and overcome various challenges: Managing cash reserves and sales expectations, while establishing a customer base and a market presence are some of the biggest trials you will have to confront with decisiveness at this particular stage of the business life cycle.

3. Growth

At the growth stage of the business life cycle, your enterprise begins to solidify its place in the market. Your business strategy begins to settle and your clients are able to explain your business model to other prospects.

Businesses at this stage tend to have:

- Customers and clients of 7+ years

- Strong cash flow and profits

- Low turnover

This is the path toward making the most of your business potential: as you grow into the role of your company’s leader, a competent team of highly-qualified individuals should take over a number of big responsibilities.

Goal: Maximizing your profits and your customer base; creating a solid, intricate corporate and team structure. Achieving this would support your business in making the jump from growth to maturity, something only 30% of firms achieve each year.

Challenge: Addressing the new demands of your business, such as attending to new customers, expanding your workforce, managing revenue and outperforming the competition.

What to focus on:

- Turn your focus inward: The key point here should be building a team by hiring quality people to run segmented operations. As the manager of your business, you should spend time on whatever helps the company grow and anticipate barriers that could decelerate this growth. Through a well-established recruitment process, create order and cohesion with clearly defined objectives.

- Strengthen your customer relationships: Your high-profile employees should take a more proactive stance toward client relationships as well as internal processes. Both experienced senior leaders and workers at lower levels should partake in helping your clients become advocates, thus pushing your enterprise to grow even further.

- Require investments: To deliver your business into the maturity stage, the growth phase needs investment. Outside investment capital is what you will likely have to require through either investors or debt. In the case of the former, you will gain advisors and give up equity. With the latter, you retain equity and sign personal guarantees with banks for funding.

4. Maturity

The main characteristics of a business at the maturity stage are:

- Annual growth of around 5%

- Tenured employees of around 8 years

- Branches or subsidiaries

This is the period of the biggest level of security you as a business manager may feel since starting out. This security stems from professional management running a daily business, stable annual profits and relative predictability of the overall business situation.

Your business is consistent and dependable, can defend its market position and expand into new verticals through the sheer power of brand recognition. This, alongside a strong cash position, makes your business attractive for acquisitions and mergers.

As a decision-maker, this may leave you with two choices: to reinvest in your company and its sustainability, or to exit and cash out to begin new ventures.

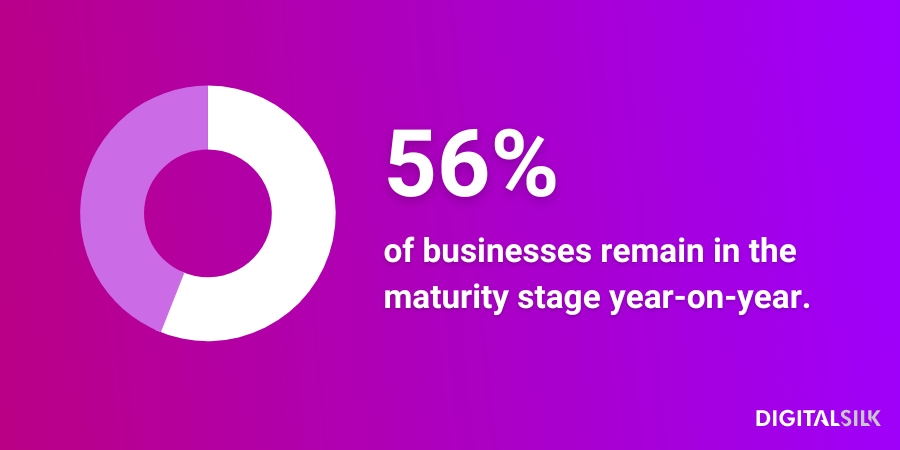

Goal: Deciding the future of your business and your involvement in it. Over half of businesses at this stage will remain in the maturity phase year-on-year as they maximize profits and assess their options.

Challenge: Analyzing the potential benefits and drawbacks of each choice and making an informed decision.

What to focus on:

- Expanding the business: Before deciding on this step, ask yourself if the business can sustain more growth. What are the market opportunities, if any, for another expansion? Can you cover the possible failure financially? Are you, as a leader, fit to navigate the challenges that new expansion would bring?

- Finding an exit strategy: This step will require a great deal of internal and external company position analysis. You, along with the management team, must communicate the right information at the right time, to the right people. You can perform this exit through a partial or full sale of the business. How the sale process will turn out will depend on the type of business you have and the decisions you make about moving forward.

5. Renewal/Decline

After a period of stability and success, a business may start to decline in revenue, profits, internal structure and external brand reputation.

A sure sign of any company’s decline is when leaders and owners no longer show an inclination toward investing in people or technology, but instead look at what they can take from the business as they plan their withdrawal.

However, renewal efforts should really begin before the decline phase sets in – good business leaders should be able to anticipate the change in business and market beforehand.

Goal: Reinventing your business by innovating and reinvesting or cashing out.

Challenge: Taking an honest, timely look and identifying the spectrum on which your business falls – investing and expanding or selling and exiting.

What to focus on:

- Assemble a team of people who are experts on mergers and acquisitions: This should include accountants, lawyers, investment bankers and other relevant parties who can see to it that the merger process checks all legal and financial boxes.

- Talk with sales and marketing about reinvesting: They can help figure out how to meet emerging changes in the market and whether there is capacity within the company to meet these changes. This might include modifying current offerings or inventing a completely new business model, which is both time-consuming and costly.

3 Real-Life Business Life Cycle Examples

Having looked at each of the five business life cycle stages in depth, let’s analyze some real world examples of businesses and their owners who either got it right or wrong.

1. Blockbuster

Founded in 1985, Blockbuster’s rapid early-life growth led to the video rental chain operating with nearly 3,600 stores in 1993. Having reached growth and maturity within just eight years, Blockbuster was subject to a merger worth $8.4 billion in 1994.

Over the next decade, Blockbuster continued its market domination and reaches peak maturity. However, the rise of Netflix, paired with failed takeover bids for Hollywood Video and Circuit City, led to falling sales.

Blockbuster had reached its infamous decline.

By 2010, the company had filed for bankruptcy and as of 2023 there is just one Blockbuster store remaining, located in Oregon.

2. PayPal

Elon Musk’s earliest ventures are a blueprint for successful business life cycle management. Having founded the online business directory Zip2 in 1995, he sold the company just four years later for $307 million.

However, it was PayPal where Musk made his billions. Originally named X.com (a URL which now leads to Twitter), the online payments company was founded by Musk in 1999.

Following a merger with Confinity, rapid growth and a name change to PayPal, the business was sold to eBay for $1.5 billion in 2002.

A gigantic deal at the time, PayPal’s market value spiked to $362 billion 2021 before slumping to $70 billion in 2023 – perhaps 20 years after Musk sold his stake PayPal has finally reached its decline stage.

3. Linktree

Founded in 2016, Linktree is a link in bio tool, allowing businesses and content creators to advertize all of their content in one place.

Today, Linktree is used by over 35 million users, and its most recent valuation places the company at $1.3 billion.

Linktree continues to grow by adding new features like payments and Shopify integration, and only time will tell if its owners choose to sell once it reaches maturity.

Business Life Cycle Stages: Takeaways

Understanding the business life cycle and your position in it makes it that much easier to predict pending roadblocks and, with careful planning, stay one step ahead of these challenges.

The 5 stages of the business life cycle are:

- Seed and development

- Startup

- Growth

- Maturity

- Renewal/Decline

Business aims, strategies and objectives are not set in stone – they change as your business and the surrounding market change. Being aware of what stage of the business life cycle you’re at can help with anticipating what’s coming around the bend.

The key takeaways across all stages of the business life cycle include:

- Consider your business’s place in the market

- Establish your company’s business structure

- Listen to feedback and adjust your business model

- Find a sustainable cash flow

- Turn your focus inward toward recruiting quality people and delegating key duties

- Expand the business or find an exit strategy

- Reinvest to innovate or sell to maximize profits

The mixture of business acumen, instinct and the ability to interpret the signs of change in your environment will all impact the precision of your decision-making when moving from stage to stage.

Regardless of what life cycle stage your business is experiencing, our team of expert consultants are on hand to guide you through its decision-making complexities. Contact us online, call us at (800) 206-9413 or fill in our request a quote form below to learn more about our bespoke consulting services.

"*" indicates required fields