Startup Failure Rate Statistics: Key Highlights

-

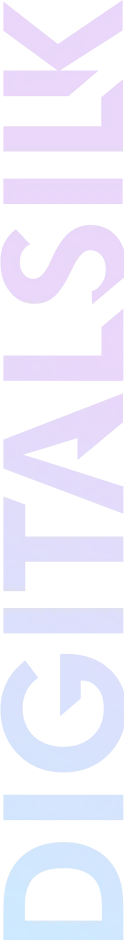

90% of global startups fail at some point in their lifecycle.

-

Only 0.05% of startups secure venture capital funding, which is about 1 in 2,000.

-

The failure rate for AI startups reaches 90%, significantly higher than traditional tech.

Startup failure first year statistics show that roughly 20% of private sector establishments fail in that time frame, while that number rises to around 50% by year five.

These figures are crucial for entrepreneurs and investors alike, as they shape everything from funding strategies to expectations about product development and market readiness.

Understanding startup failure rate statistics for 2026 and beyond can help you make informed decisions about what to create, where you invest and how you anticipate risk.

General Launch, Funding And Startup Failure Statistics

Behind every new startup headline is a set of influential factors that define how companies are formed, financed and sustained.

Strong birth numbers contrast with slower funding cycles, concentrated investment hubs and rising barriers to reaching substantial growth.

The startup failure rate 2026 statistics below provide the context needed to understand how these elements interact across the current market landscape.

- 14.7% of the U.S. population is involved in business startups.

- The United States has the largest number of unicorns, with 656 privately owned companies valued at over $1 billion.

- In December 2024, the private sector recorded 322,000 establishment births with a birth rate of 3.4, a slight uptick from the previous quarter’s 316,000.

- Global startup failure rate statistics show that 90% of businesses fail at some point in their lifecycle.

- In the second quarter of 2025, the median gap between funding rounds in the private market stretched to 696 days across all stages, a small 5% uptick on both a quarterly and annual basis.

- California-based startups received 50% of all venture capital allocated from Q3 2024 to Q2 2025.

- San Francisco’s startup ecosystem brought in $36.7 billion in the second quarter of 2025, up 138% from the comparable period two years before.

- Raising money from a venture capital firm is extremely challenging, with only 0.7% of startups receiving an equity check and just 8% of those succeeding, which brings the combined success rate to roughly 0.05%, or about 1 in 2,000.

- Approximately 75% of venture-funded startups fail, with some estimates suggesting the actual rate is even greater due to inconsistent reporting.

- Limited funding availability is causing a 71% drop in new unicorn births, as late-stage companies cannot raise the large rounds needed to reach a $1 billion valuation.

What These Numbers Mean For You

- Expect heavier competition. With so many new founders entering the market, businesses need strategic positioning and faster validation cycles to maximize conversions.

- Use industry trends to guide decision-making. With startup failure rate statistics indicating failure rates across categories call for more rigorous demand testing, improved unit economics and earlier alignment on market fit.

- Reassess late-stage expectations. Fewer unicorns emerging from capital shortages means leadership teams should design growth plans that aren’t reliant on oversized valuations.

Startup Failure Rate Reasons Statistics

Building a startup depends on more than product development because early traction comes from how effectively a company positions itself, generates leads and builds brand awareness.

The choices founders make around messaging, budgeting and market fit influence whether customers engage or whether promising ideas lose momentum before they mature.

Leadership strength, team experience and operational pressure points also play a significant role in determining how resilient a young company can be as it grows.

The startup failure rates statistics below outline the patterns that frequently disrupt early-stage progress and reveal why so many projects struggle to reach long-term viability.

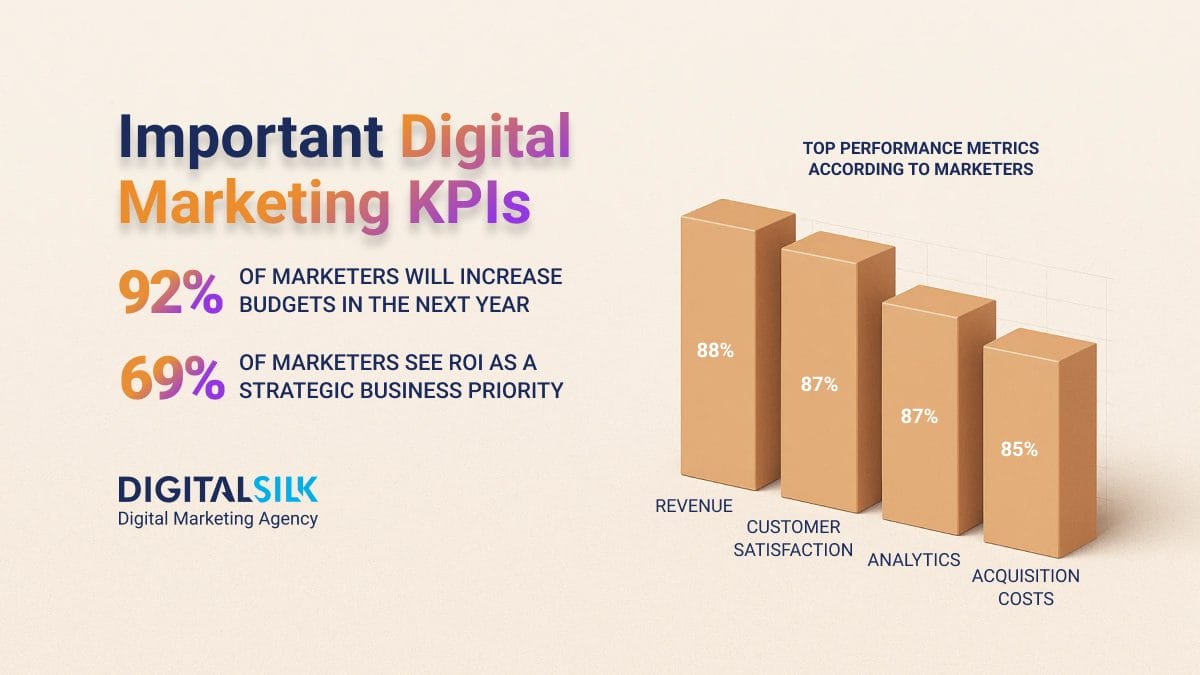

- Startup project failures can be attributed to several causes, yet marketing mistakes dominate at 69%.

- Among those marketing issues, 34% identify the lack of product-market fit as the most common problem.

- Financial problems rank third among project challenges, with 50% of initiatives starting without any budget and more than 75% relying on self-funding.

- From a funding perspective, 77% of startups are bootstrapped, meaning founders carry the full financial load instead of securing external investment.

- Surprisingly, financial problems are named as the primary reason for failure in only 16% of startup projects.

- Another study reinforces the importance of product-market fit, finding that most startup failures, or 42%, occur when there is no real market demand for the product.

- According to 95% of investors, leadership credibility and experience form the most important nonfinancial gauge of performance, with companies that excel in these areas often producing earnings two times higher than peers.

- More than 80% of companies fail even after developing products that perform well in the market.

- Rapidly scaling companies often struggle at major inflection points, with investors linking 65% of portfolio failures to people and organizational challenges.

What These Numbers Mean For You

- Test demand before scaling effort. Early discovery calls, small paid trials and pre-orders reveal more about viability than assumptions or feature planning.

- Refine messaging through structured testing. Treat headlines, positioning statements and outreach scripts as experiments you run in short cycles to learn what resonates.

- Invest in leadership capability. Decision-making consistency, communication quality and prior operating experience all shape how investors and early hires evaluate the company.

AI Startup Failure Rate Statistics For 2026

The growing use of AI has created a surge of new ventures, yet the pace of development often outstrips the ability of these companies to build sustainable products and keep engagement high.

Investment patterns, regional concentration and rapid experimentation shape how quickly these startups scale and how easily they run into structural limits.

Many of the early challenges tie back to demand, data quality and the speed at which brands attempt to validate their ideas in a market that changes faster than most can respond.

The following startup failure statistics for 2026 highlight the pressures unique to AI-driven companies and reveal why so many struggle to reach stability despite strong interest in the category.

- Investors poured $73.6 billion into GenAI application startups in the first three quarters of 2025.

- This brought total investment across the GenAI and broader AI ecosystem to $110.17 billion for the year.

- In the second quarter of 2025, global venture funding to AI reached $40.6 billion.

- 95% of generative AI pilot projects in enterprises fail to deliver any measurable ROI, with only 5% yielding a positive return.

- The failure rate for AI startups reaches 90%, significantly higher than the roughly 70% seen among traditional tech firms.

- Based on startup failure rate statistics, 42% of AI businesses fail due to insufficient market demand, the largest share of any category.

- AI startups have a median lifespan of about 18 months before shutting down or attempting a last-minute pivot.

- In the first quarter of 2025, AI startup funding plummeted 23%, marking the sharpest quarterly drop since the 2018 crypto winter, when collapsing cryptocurrency valuations triggered a broad pullback in Silicon Valley investment.

- Startup failure statistics in 2025 showed that the cohort of AI startups launched in 2022 burned through $100 million in three years, a cash-burn speed that doubles that of earlier generations.

- According to private-market investment advisors, 85% of AI startups are expected to be out of business within three years.

- Around 85% of AI models and projects fail due to poor data quality or a lack of relevant data.

What These Numbers Mean For You

- Simplify complex capabilities. Enterprise buyers often struggle to understand AI features, so packaging use cases in plain language and tying them to familiar workflows improves engagement and conversion.

- Address data readiness upfront. Since most AI model failures stem from poor data quality, helping clients diagnose and prepare their data environments increases the likelihood of long-term retention.

- Create adaptability in your product. Fast-changing expectations in AI mean clients pivot frequently, so modular features and configurable components help products stay relevant through shifting priorities.

SaaS Startup Failure Rate Statistics

Founders in the software-as-a-service (SaaS) space chase growth at a pace few other industries attempt, and the volume of new ventures aiming for large outcomes continues to expand.

Growth potential, valuation milestones and competitive pressure shape how these startups evolve, especially as more founders pursue billion-dollar targets from day one.

Even with strong representation among emerging unicorns, the gap between early promise and sustained performance remains wide for most founders.

The SaaS startup failure rate statistics that follow show how often software and online service companies fall short of breakout growth and what the broader market signals about their chances of long-term growth and customer loyalty.

- As the total number of annual startup shutdowns reaches 966, accounting for 25.6% of all companies tracked, SaaS firms make up 32% of that count.

- Just 28% of software and online service startups survive long enough to reach $100 million in revenue, while only 3% ultimately get to the $1 billion mark.

- The software industry holds the top position in emerging unicorns worldwide, with 248 companies expected to reach billion-dollar valuations.

- In 2025, the market saw 149 newly formed unicorns, 91 of which emerged from the information technology sector, with a valuation of $216.4 billion.

What These Numbers Mean For You

- Anchor around one primary customer segment. With many ventures chasing billion-dollar valuations, a narrow ideal customer profile, tailored packaging and segment-specific messaging help you win your first market before thinking about broader reach.

- Use pricing as a strategic tool. Large aspirational valuations only materialize when contract values grow over time, so experiment with pricing models such as usage-based, value-based or hybrid structures that better match how customers gain benefit.

- Invest heavily in onboarding and daily use. Since long-term growth depends on how deeply customers embed your product, prioritize setup, in-app guidance and recurring prompts that build habits and make renewal feel like the obvious choice.

Grow Your Brand Online With Digital Silk

High-growth brands operate in markets where conditions change quickly, competition scales rapidly and long-term traction depends on early strategic choices.

The startup failure rate statistics you’ve seen highlight how much stability comes from deliberate positioning, sustained engagement and clear value delivery.

Digital Silk helps businesses expand their visibility online, attract the right audiences and build experiences that turn interest into measurable growth.

As a recognized web design agency, our services include:

Contact our team, call us at (800) 206-9413 or fill in the Request a Quote form below to schedule a consultation.

"*" indicates required fields