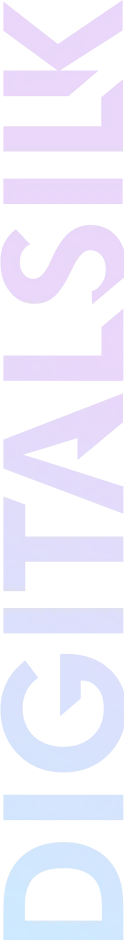

Biotech Companies In Los Angeles: Key Highlights

-

California secures $5.3 billion in NIH funding annually and accounts for 40% of U.S. life sciences patents.

-

Greater Los Angeles hosts 3.966 life sciences establishments generating $60.2 billion in economic output in 2025.

-

Amgen leads LA’s biotech sector with a $156 billion market cap, $34.13 billion in revenue and over 28.000 employees.

The U.S. biotechnology market is projected to hit $699.2 billion in 2025 and is expected to grow at 12.5% annually until it reaches $1.794 trillion by 2033.

Within this booming sector, Los Angeles has carved out a distinct niche where leading research institutions, cutting-edge startups and clinical powerhouses are driving advances in gene therapy, regenerative medicine and platform technologies.

Its biotech sector thrives on collaboration between academic labs, health systems and venture-backed innovators who are turning bold science into scalable solutions.

In this post, we’ll highlight the best biotech companies in Los Angeles that are redefining what’s possible in life sciences and their impact on the overall industry.

The table below provides a comparative snapshot of leading biotech companies based in Los Angeles, highlighting key metrics and areas of specialty.

| Company | Market Cap (2025) | Revenue (2024) | Employees (2024) | Specialty |

| Amgen | $156 billion | $31.13 billion | 28.000 | Biologics, Oncology |

| Arrowhead Pharmaceuticals | $2.52 billion | $545.21 million | 609 | RNAi Therapies |

| Kite Pharma | $10.31 billion | $294 million | 4.000 | Cell Therapy |

| Xencor | $0.62 billion | $110.49 million | 250 | Antibody Engineering |

| Fulgent Genetics | $0.58 billion | N/A | 1.313 | Genetic Testing |

| Niagen Bioscience | $0.89 billion | $99.60 million | 104 | Nutraceuticals |

| Acelyrin | $540 million IPO | N/A, merged | N/A, merged | Immunology |

| Aadi Bioscience | $94.89 million | $25.98 million | 15 | Precision Oncology |

| Puma Biotechnology | $0.17 billion | $230.47 million | 269 | Cancer Therapeutics |

| Armata Pharamaceuticals | $80.34 million | $5 million | 60 | Bacteriophage Therapy |

Overview Of The Biotech Industry In California

Biotechnology companies in Los Angeles are driving measurable impact within one of California’s most high-performing sectors.

Fueled by the state’s booming manufacturing and tech industries, these firms are generating billions in economic output, attracting major NIH funding and producing a significant share of the country’s life sciences patents.

- California is home to 16.576 biotech and life sciences establishments.

- The state secures $5.3 billion in NIH funding annually and accounts for 40% of U.S. life sciences patents, helping bioengineering companies in California push scientific boundaries.

- In 2023, California exported $9.3 billion in pharmaceuticals and medicines and ranked as the #1 U.S. exporter of medical equipment and supplies by value.

- The Greater Los Angeles area hosts 3.966 life sciences establishments, with a total economic output of $60.2 billion in 2025.

- The average annual salary for life sciences professionals in the Greater Los Angeles area is $109.170.

- Biotech industry employment in Los Angeles County stands at 13.006, reflecting the region’s growing role as a major contributor to life sciences innovation and talent development.

Why These Numbers Matter For The Top Biotech Companies In L.A.

- Refine your lead generation strategy: Use L.A.’s concentration of life sciences firms to segment outreach by function and target R&D for partnerships, manufacturing hubs for supply deals and distribution players for channel expansion.

- Prioritize conversion-ready positioning: As market saturation increases, focus your messaging on outcomes, not capabilities. Highlight clinical milestones, time-to-market advantages or proven ROI to shorten sales cycles.

- Integrate global scale early: Whether you’re in diagnostics, therapeutics or devices, plan for international distribution upfront. L.A.’s export leadership makes it easier to operationalize cross-border growth when the groundwork is already laid.

Top Biotech Companies In Los Angeles

The state’s corporate leaders are driving serious momentum across drug development, genetic testing and biologics, producing both clinical breakthroughs and strong Return on Investment (ROI).

Backed by California’s broader healthcare industry, these companies are expanding operations, increasing headcount and competing globally in revenue, valuation and R&D output.

Big biotech companies in L.A. are at the center of this growth, turning scientific expertise into tangible impact across the City of Angels and beyond.

- Amgen, headquartered in the Greater Los Angeles Area, ranks fourth among global biotech companies in 2025 with a market capitalization of $156 billion.

- The company generated $34.13 billion in total revenue in 2025, placing it seventh among the top ten U.S. biotech and pharmaceutical companies by revenue.

- Amgen invested $5.88 billion in research and development in 2024, placing it fifth among the leading global biotechnology companies by R&D expenditure.

- As one of the best biomedical companies in L.A., Amgen reported a total of 28.000 employees in 2024, marking a 4.87% year-over-year increase.

- Arrowhead Pharmaceuticals, a Los Angeles County biopharmaceutical company developing RNAi therapies to target harmful genes, has a market cap of $2.52 billion in July 2025.

- In the last 12 months, Arrowhead Pharmaceuticals (ARWR) generated $545.21 million in revenue.

- As one of the top L.A. biotech companies, ARWR’s headcount reached 609 in 2024.

- Before merging with Alumis Inc. in 2025, Acelyrin completed a $540 million Initial Public Offering (IPO) on stock exchanges, the largest among biotech companies worldwide at the time.

- Kite Pharma, based in Santa Monica and acquired by Gilead Sciences in 2017, reached a market capitalization of $10.31 billion in 2025.

- By the end of 2024, the company recorded annual revenue totaling $294 million.

- With over 4.000 employees worldwide, Kite Pharma fosters a collaborative culture centered on its core goal of curing cancer.

- As of July 2025, Niagen Bioscience’s year-to-date valuation has climbed to $0.89 billion in market cap.

- Niagen Bioscience’s 2024 revenue totaled $99.60 million, driven by 19.18% growth over the previous year.

- In 2024, the company operated with a staff of 104.

- Xencor’s market value reached $0.62 billion as of July 2025, reflecting its year-to-date position.

- In 2024, the company brought in $110.49 million in revenue across its operations.

- Xencor’s employee count reached 250 in 2024.

- Fulgent Genetics is valued at $0.58 billion in market cap as of July 2025.

- The Los Angeles–based biotechnology company, focused on genetic testing for oncology, infectious and rare diseases and reproductive health, reported total assets of $1.2 billion in 2024.

- As of 2024, Fulgent Genetics had 1.313 employees across its organization.

- By mid-2025, Aadi Bioscience was valued at $94.89 million in market capitalization.

- The Pacific Palisades–based company recorded $25.98 million in revenue in 2024.

- Aadi Bioscience had 15 employees on record as of the end of 2024.

- Among biotech firms in Los Angeles, Armata Pharmaceuticals reported a market capitalization of $80.34 million as of July 2025.

- Armata Pharmaceuticals’ total revenue for 2024 amounted to $5 million.

- The company supported its work with 60 employees in 2024.

- As of July 2025, Puma Biotechnology has a market capitalization of $0.17 billion, maintaining its position among the top biotech companies in L.A.

- The company brought in $230.47 million in revenue during 2024 while continuing to develop and commercialize novel therapeutics for the treatment of cancer.

- Puma Biotechnology’s headcount stood at 269 employees in 2024.

- Capsida Therapeutics is currently estimated to bring in $22.3 million per year in revenue.

- The company is supported by a team of 122 professionals.

Why These Numbers Matter For The Top Biotech Companies In L.A.

- Differentiate your brand early: In a region filled with billion-dollar competitors, you need a clear, memorable identity that communicates your value to partners, investors and talent from the first click to the follow-up meeting.

- Treat your website as a conversion engine: In a region packed with investor-backed firms and rising valuations, your digital presence must move beyond surface-level branding. Focus on user experience, clear calls-to-action and targeted content that drives pipeline growth, talent acquisition and partner engagement.

- Simplify complex science: Translate your technical work into clear, benefit-driven language across your digital channels and touchpoints to engage decision-makers beyond the lab.

Why Los Angeles Is A Hub For Biotech Startups

Los Angeles isn’t just a home for biotech headquarters, but also a hub of interdisciplinary collaboration.

The region’s biotech ecosystem thrives thanks to:

- Academic Powerhouses: Institutions like UCLA, USC and Caltech fuel biotech innovation with cutting-edge research and strong tech transfer pipelines. UCLA alone contributes over $1 billion annually in research funding.

- Startup Incubators: Organizations like BioscienceLA and LARTA Institute provide early-stage companies with mentoring, workspace and access to capital. BioscienceLA also acts as a regional connector between academia, government and investors.

- Clinical Research Infrastructure: LA’s extensive hospital and health system network (Cedars-Sinai, UCLA Health, Keck Medicine of USC) provides an ideal setting for clinical trials, patient recruitment, and translational medicine.

- Venture Capital & State Support: Biotech startups benefit from a healthy venture capital ecosystem and state-led initiatives like California Life Sciences (CLS) and Californians for Cures, which help bridge funding and regulatory gaps.

Key Insight: LA’s biotech growth is both company-led and ecosystem-enabled.

The synergy between science, funding, and health systems is positioning the region for long-term industry dominance.

Future Outlook On The Biotech Industry In L.A.

Los Angeles is shifting from an emerging biotech market to a strategic epicenter for science, investment and commercial growth.

With strong performance from established players and increased interest from funders, collaborators and talent, the region is expected to expand its role in shaping the next generation of life sciences innovation, including:

- Increased public listings and acquisitions: Expect to see more Initial Public Offerings (IPOs) and acquisitions as biotech companies in L.A. continue to demonstrate revenue traction, clinical progress and scalable platforms that attract institutional investors and global buyers.

- Improved integration with digital health and AI: Biotech firms in L.A. will increasingly collaborate with artificial intelligence (AI) and digital health partners, using data-driven tools to accelerate drug discovery, diagnostics and patient engagement strategies.

- Growing demand for differentiated branding: As competition intensifies, companies will need sharper brand positioning and conversion-focused digital experiences to stand out in crowded funding, talent and partner pipelines.

- Global expansion from local platforms: Biotech companies rooted in L.A. will look beyond U.S. borders earlier in their growth cycle, leveraging California’s export infrastructure and reputation to scale clinical trials, partnerships and distribution.

- Rising pressure to recruit and retain top talent: With biotech salaries already high and headcounts growing, companies will need strong employer branding and purpose-driven culture to compete for specialized researchers, operators and executives.

- Greater emphasis on commercialization strategy: Scientific innovation alone will not be enough. Future leaders in L.A. biotech will need digital marketing, market access planning and product launch capabilities built into their early-stage roadmaps.

Grow Your Miami Brand With Digital Silk

attract investment and compete globally.

As scientific breakthroughs turn into commercial opportunities, success will depend on how clearly and confidently you present your value to the world.

Digital Silk’s in-house team of web designers and developers, branding and marketing specialists builds custom digital platforms that translate complex science into compelling experiences that drive awareness, engagement and conversions.

As premium web design agency, our services include:

- Web design for L.A. brands

- Fully custom web design

- Custom web development

- Branding services in L.A.

- Digital marketing

For each project, our dedicated experts provide transparent and proactive communication to deliver tangible business results.

Contact our team, call us at (800) 206-9413 or fill in the Request a Quote form below to schedule a consultation.

"*" indicates required fields