Digital Transformation In CA Financial Services: Key Highlights

-

AI reshapes financial workflows: Institutions are embedding machine learning across underwriting, fraud prevention and customer engagement.

-

APIs unlock banking ecosystems: Open banking allows third-party fintechs to securely integrate features like credit scoring, transfers and account views into their apps.

-

Blockchain reshapes transactions: Decentralized systems streamline payments, cut onboarding time with digital identities and improve audit transparency.

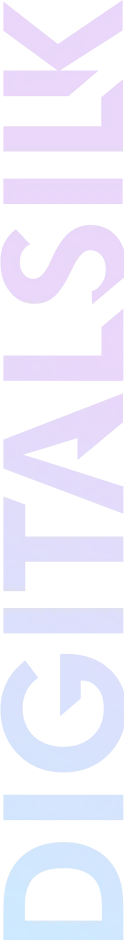

Fintech revenue in the United States is projected to reach $70.59 billion by 2028, with California delivering 31% of all U.S. deals in the industry in 2024, even as national deal activity fell by 28% year over year.

The state’s banks, credit unions and fintech startups are racing to digitize customer experiences, automate compliance and launch new revenue models.

Unlike other markets, California’s strict privacy laws, the CCPA and CPRA, combined with a hyper-digital customer base, are accelerating innovation while raising the bar for security and trust.

This article explores key digital transformation trends in California financial services and how decision-makers can leverage them to prepare their companies for the future.

The Latest CA Financial Services Digital Trends

Emerging tech in the California financial industry is moving from pilot projects to full-scale implementation, reshaping how institutions operate and deliver value.

The following trends highlight where innovation is gaining tcahe most traction and how they’re redefining the future of the state’s financial services.

1. AI & Machine Learning Implementation

Artificial intelligence and machine learning are shifting from experimental projects to cornerstones of financial strategy, reshaping how risk is managed, products are designed and client relationships are built.

Global AI spending in the financial sector is projected to reach $126.4 billion by 2028, showing how rapidly these technologies are becoming catalysts for growth and reinvention.

Rather than serving as standalone tools, AI systems are becoming deeply embedded in decision-making, where they compress analysis cycles from months to minutes and uncover opportunities too complex for manual review.

This shift is changing how leaders allocate capital, structure teams and build customer strategies, turning data into a strategic asset rather than a byproduct of daily operations.

Key areas where you can use AI in California financial services:

- Fraud detection and risk insights: Identifying irregularities as they occur to reduce financial exposure and protect reputation

- Underwriting and claims automation: Improving accuracy and speed while reducing operational drag

- Robo-advisors and wealth management: Delivering personalized recommendations that respond to behavior and market shifts

- Customer service innovation: Using AI assistants to resolve routine and complex inquiries so teams can focus on high-value work

- Predictive analytics: Analyzing vast datasets to anticipate trends and guide strategic decisions

Effective adoption tends to move through clear stages, beginning with strong data foundations, scalable infrastructure and the automation of routine tasks that clear space for innovation.

From there, AI can be embedded across underwriting, claims, wealth management and advisory services, then evolved into new products and models shaped by regulatory shifts and guided by ethical practices that sustain trust.

For instance, San Francisco-based True Link Financial provides prepaid cards and accounts with fraud‐detection algorithms plus configurable merchant restrictions and spending limits, helping protect vulnerable groups such as seniors from financial abuse.

2. Blockchain & Distributed Ledger Tech (DLT)

Blockchain and distributed ledger technologies (DLTs) record transactions across decentralized networks where each participant holds an identical, time-stamped copy of the data, removing the need for central authority.

In 2025, 71% of financial firms are making major investments in blockchain and DLT, up 12% from the previous year, as leaders push for infrastructure that can handle higher volumes with greater speed and security.

They enable payments that settle in seconds, streamline Know Your Customer (KYC) verification with reusable digital identities and bring transparency to transactions that once relied on multiple intermediaries.

The same networks are fueling the rise of decentralized finance and forcing institutions to build robust crypto compliance frameworks that protect trust while supporting innovation.

Some ways you can use DLT and blockchain in CA banking and financial services include:

- Payments and settlements: Real-time cross-border transfers with verifiable records for all participants

- KYC and compliance: Shared digital identity systems that cut onboarding times and reduce operational overhead

- Transaction transparency: Immutable records that increase trust and streamline audits

- DeFi and crypto oversight: Integrating decentralized finance platforms into regulated frameworks to balance innovation with accountability

- Smart contracts: Automating claims, trades and settlements without manual reconciliation

As blockchain infrastructure scales, it is reshaping web development trends in finance, pushing platforms toward modular designs, interoperability and built-in security.

This shift is creating a new digital fabric where every transaction, identity and contract is part of a single connected system.

For instance, Figure Technologies, which operates the Provenance Blockchain, enabled $6 billion in home-equity lending in the 12 months to June 30 2025 and completed a $355 million mortgage securitization, the first blockchain-based deal to receive an AAA rating from S&P on its senior classes.

3. Cloud-First Financial Infrastructure

Financial institutions are shifting vast operational cores into the cloud to escape the rigidity of legacy systems and gain the agility to respond as markets change.

94% of financial services leaders say the cloud is the future of their IT operations, reflecting how deeply it is shaping decisions on everything from budgeting to client experience.

Instead of planning around hardware cycles, institutions can direct capital toward innovation, spin up new services in days and respond faster to regulatory or market pressures without overextending internal teams.

How to use cloud adoption in financial services to maximize results:

- Hybrid cloud deployment: Combining public and private environments to balance security and agility

- Scalability on demand: Expanding or reducing computing resources in real time without heavy capital investment

- Regulatory compliance: Using cloud-native governance and monitoring to meet evolving oversight requirements

- Operational efficiency: Automating updates, maintenance and disaster recovery to free internal teams for strategic work

Cloud adoption is reshaping how financial systems are designed, encouraging modular architectures, API-driven ecosystems and continuous delivery pipelines that let institutions adapt products in near real time.

It’s turning core platforms into living systems that can evolve alongside shifting regulations, customer expectations and market dynamics.

4. Rapid Regtech Evolution

Regtech automates how financial institutions track, interpret and meet regulatory obligations, from data privacy laws to anti-money laundering rules.

These systems are replacing manual checks with real-time monitoring, turning compliance from a reactive process into a predictive one.

Companies are building AI-driven engines that scan new regulations, forecast their impact and recommend policy updates in hours rather than weeks.

Key areas where RegTech is advancing in California:

- Real-time compliance monitoring: Automated tracking systems that flag risks across vast datasets as regulations shift

- AI-powered regulatory intelligence: Machine learning tools that interpret new rules, forecast their impact and suggest policy updates

- Data privacy and security: Encryption and secure storage platforms designed to safeguard sensitive client information under California Consumer Privacy Act (CCPA) and similar frameworks

- Anti-money laundering (AML): Automated workflows and anomaly detection that help firms identify and prevent financial crime

- Private market compliance: Platforms that streamline regulatory requirements and back-office tasks in deal-making, capital raising and M&A

California’s dominance comes from treating regulatory complexity as a space for innovation rather than an obstacle.

That mindset is transforming how financial institutions operate, turning compliance into a strategic capability that strengthens trust and accelerates growth.

5. Data Analytics & Predictive Modeling

Every transaction, interaction and market move generates valuable data and financial institutions are turning that constant flow into foresight that guides high-stakes decisions.

In an industry where timing defines profitability, data analytics in CA finance can help anticipate market shifts, price risk in real time and personalize services down to the individual level.

93% of financial services respondents say data and analytics have increased their profits, which shows how deeply these capabilities influence strategy across the sector.

Companies use behavioral data to tailor product recommendations, apply predictive models to accelerate loan approvals and uncover investment opportunities that were once buried in fragmented datasets.

Key ways data analytics is reshaping CA digital finance solutions:

- Risk management: Modeling credit, market and operational risks using historical and live data to reduce potential losses

- Customer insights: Segmenting clients by behavior and preferences to create tailored services and targeted outreach

- Investment analysis: Evaluating market trends and historical performance to shape strategy and improve returns

- Fraud detection: Flagging anomalies in real time to prevent fraudulent transactions before they escalate

- Regulatory compliance: Automating reporting and monitoring to reduce compliance costs and human error

- Operational efficiency: Streamlining internal processes to cut cycle times and improve resource allocation

As these models become more sophisticated, they’re moving decision-making closer to real time and giving leaders the agility to adapt as markets shift.

What began as a way to track performance is now becoming a foundation for shaping future growth.

6. Open Banking & API Innovation

For decades, customer data sat locked inside individual institutions, but open banking in CA is breaking those walls and turning data into a shared resource that fuels collaboration.

Banks are now granting secure API access to trusted third parties, allowing fintechs to build services that draw from multiple accounts in real time and give customers a unified view of their financial lives.

Leveraging APIs for customized workflows was the leading open application programming interface goal for 49% of U.S. banks in 2024, a signal that many institutions now see modular, tailored systems as the path to more competitive offerings.

Where open banking is driving the digital transformation in CA financial services:

- Bank–fintech interoperability: Secure data sharing that enables joint product development and seamless customer experiences

- Customer data portability: Allowing users to control and share their financial data across institutions without friction

- Embedded financial services: Integrating payments, credit and investment tools into non-bank platforms for new revenue opportunities

- Automated workflows: APIs that connect internal systems to third-party tools, reducing manual work and accelerating delivery

Open banking is shifting finance from isolated systems to collaborative networks and California is becoming one of its primary proving grounds.

7. Cybersecurity Advancements

Cyberattacks are evolving faster than traditional defenses can adapt and the stakes now reach far beyond financial losses.

A single breach can trigger regulatory scrutiny, disrupt operations and erode customer trust in ways that take years to recover.

93% of financial leaders are investing in cybersecurity and institutions are shifting toward adaptive defenses that predict threats, contain breaches early and protect sensitive data under regulations like the California Consumer Privacy Act (CCPA) and California Privacy Rights Act (CPRA).

Key areas driving cybersecurity in financial services in CA include:

- AI-enabled threat detection: Real-time analysis that flags suspicious behavior before it escalates

- Zero-trust security models: Continuous verification of users and devices to contain breaches

- Privacy compliance (CCPA, CPRA): Built-in data governance controls that protect personal information and maintain regulatory trust

Key Drivers Behind The Financial Technology Trends In California

Digital transformation in CA financial services is accelerating because the market itself has become more unpredictable and harder to navigate at scale.

The factors below are shaping those decisions and driving the trends transforming the state’s financial sector:

- Higher customer expectations: Mobile-first users form a large share of California’s financial customer base and they expect seamless digital access, real-time account visibility and tailored experiences that adapt to their behavior. This demand is forcing institutions to rethink how they design products and measure engagement.

- Evolving regulatory environment: 75% of financial services executives say complex regulatory developments are the biggest factor in their investment decisions. Constant shifts in data privacy and fintech oversight influence where capital goes and force institutions to rebuild compliance systems to track and apply new rules faster.

- Intensifying competitive pressure: Neobanks and fintech startups are capturing market share with lower-cost, highly personalized offerings, while innovation hubs like Silicon Valley keep raising the bar for speed and creativity. 75% of executives say they feel confident in their tech transformation roadmap, which is accelerating product cycles as traditional institutions work to keep pace.

- Breakthroughs in emerging tech: The rapid maturity of AI, blockchain APIs and scalable cloud platforms is making once-costly capabilities accessible to even mid-sized institutions. Venture capital continues to flow into California fintech, giving firms the resources to experiment, scale quickly and translate ideas into market-ready products.

Best Practices For Adopting California Fintech Innovation

Modernizing financial services in California means building systems that adapt quickly and drive measurable growth.

These practices help banks, credit unions and fintechs boost conversions, generate stronger leads and build lasting trust:

- Prioritize client-centered innovation: 87% of respondents say it’s important for companies to recognize them and understand their customer history to deliver more tailored experiences, which is reshaping the customer experience in financial services. Institutions are mapping user journeys, refining digital UX and tying personalization to conversion goals.

- Turn data into strategic value: Advanced analytics reveal patterns in behavior, risk and demand. Firms use these insights to design targeted offers, focus lead generation and direct resources to the highest-return opportunities.

- Embrace strategic tech partnerships: Collaborating with fintech startups, accelerators and innovation labs speeds up access to new capabilities. These partnerships shorten development cycles and open new lead channels through co-branded offerings.

- Build on flexible, scalable infrastructure: Modular APIs, microservices and cloud-native platforms let institutions scale quickly and deploy updates without disruption. This approach is shaping digital banking trends in California as firms compete on speed and experience.

- Ensure proactive risk and threat monitoring: Continuous compliance tracking and cyber-resilience audits protect customer data and sustain brand trust. This reduces risk that can stall growth and weaken sales momentum.

Challenges Slowing Digital Transformation In CA Financial Services

Despite record funding, California institutions face unique headwinds:

- Legacy core systems: Many financial institutions still rely on decades-old core banking systems running on mainframe hardware with batch-processing logic, which slows down integration with modern tech like APIs and cloud.

- Regulatory complexity: Constant changes in CCPA/CPRA rules raise compliance costs.

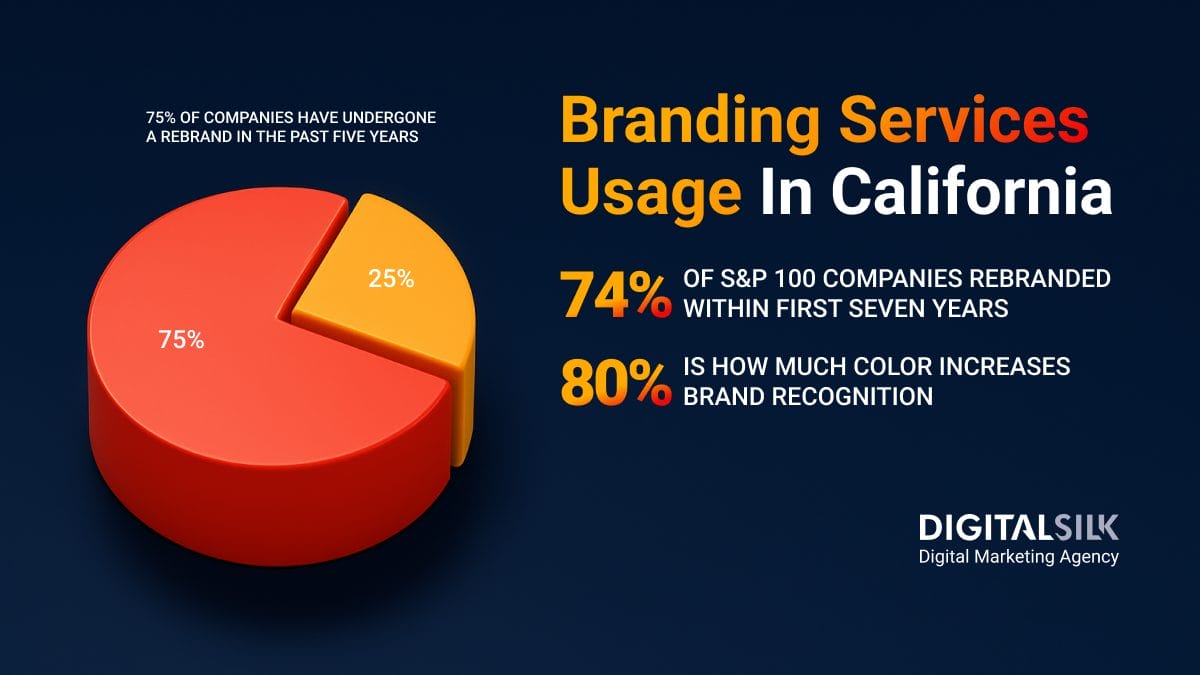

- Talent shortages: California’s tech workforce is large and growing, but demand is outpacing supply. Despite there being 1.5 million people employed in CA tech jobs, the state added only about 6.000 net tech jobs from 2020 to 2024. The median wage for computer and information technology occupations in California is $105.990, which is well above that of many other states, reflecting high competition for experienced talent.

- Cybersecurity risks: Global breach costs climbed to $4.88 million in 2024, with the financial industry seeing an average of $6.08 million per breach. These costs include lost business, regulatory compliance and recovery efforts.

- Digital equity gaps: Although 96% of Californians have some internet access at home as of 2023, only about 84% have access to broadband/high-speed internet. Among low-income, rural, non-college degree and minority households, access is significantly lower.

The Future Of Financial Services Modernization In California

California’s future will pivot from siloed products to interconnected digital ecosystems combining banking, investing and insurance within unified platforms.

Key shifts to prepare for include:

- Ethical & transparent AI: Expect mandatory explainability frameworks for credit and lending models as regulators push for bias-free decisioning.

- Climate risk modeling: New state disclosure rules will force climate-based stress testing in risk frameworks.

- Programmable payments & tokenization: CA fintech labs are piloting blockchain-based tokenized deposits for real-time programmable payments.

- Regulatory tech convergence: CCPA and CPRA compliance will shift to continuous, data-driven monitoring.

- Interoperable API networks: Expect plug-and-play banking ecosystems with secure standardized APIs linking banks, fintechs and third-party apps.

Firms that prepare for these shifts now will shape the next era of California finance.

Advance Your Digital Transformation With Digital Silk

California’s financial sector is entering a phase where innovation speed, regulatory agility and customer-centric design will define long-term relevance.

Institutions that align technology, data and strategy now will be positioned to shape markets rather than react to them.

Digital Silk helps financial organizations accelerate this transformation by building tailored digital ecosystems that drive growth, strengthen compliance and create seamless customer experiences.

As an end-to-end digital agency, our services include:

- Custom web design for California brands

- Custom web development

- Branding strategies for California businesses

- Digital marketing for California brands

Our experts use a proactive but consultative approach for every project we undertake, ensuring transparent communication and measurable results.

Contact our team, call us at (800) 206-9413 or fill in the Request a Quote form below to schedule a consultation.

"*" indicates required fields