Fintech Trends: Key Highlights

-

Profitability is accelerating: More fintech firms are proving their business models, with 69% of publicly listed companies becoming profitable in 2024, up from less than half the year before.

-

Payments remain the growth engine: Global payments revenue reached $2.4T in 2023 and is on track to hit $3.1T by 2028, reaffirming payments as the backbone of fintech’s expansion.

-

AI is driving the next leap: The Artificial Intelligence in fintech market is set to grow from $30B in 2025 to $83.1B by 2030, making AI adoption a key competitive differentiator for the coming decade.

Fintech is the backbone of global finance.

By 2030, 53% of all in-person shopping value is projected to be transacted via mobile devices, approximately $25 trillion.

That makes fintech the primary interface through which people and businesses move money.

The latest fintech trends below reveal how fast the industry is scaling and what it means for market leaders planning their next move.1

Global Fintech Market Size, Growth & Investment Trends

Fintech is rapidly reshaping the financial ecosystem.

Payments are fueling most of the revenue growth and digital wallets are changing how people check out, transfer money and manage transactions across borders.

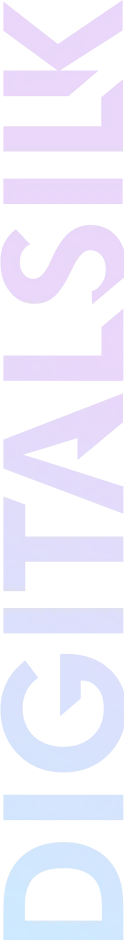

- The global fintech market was worth $340.10 billion in 2024 and is expected to reach $1,126.64 billion by 2032, with a CAGR (Compound Annual Growth Rate) of about 16.2%.

- Global fintech investment totaled $95.6 billion across 4,639 deals in 2024, hitting a seven-year low.

- However, revenues in the sector grew by roughly 21% year-over-year (YoY) in 2024, a rise from about 13% in 2023.

- 69% of publicly-listed fintech firms became profitable in 2024, an improvement from less than half in the previous year.

- North America led the global fintech market with 34.05% share in 2024.

- Fintech revenue in the U.S. is expected to reach $70.5 billion by 2028.

- Global payments revenue reached $2.4 trillion in 2023 and is projected to reach $3.1 trillion by 2028.

- In April 2024, the European Commission Instant Payments Regulation (EU 2024/886) introduced a new regulation requiring instant euro payments to be processed 24/7/365 in within 10 seconds.

- 91% of 93 central banks surveyed are exploring Central Bank Digital Currencies (CBDCs), with wholesale pilots more advanced than retail.

- In terms of investment, the Americas received $63.8 billion in fintech funding in 2024, with the U.S. alone accounting for $50.7 billion.

- Visa processed 233.8 billion transactions and handled $13.2 trillion in payment volume during its 2024 fiscal year.

- Mastercard reported a net revenue of $28.2 billion in 2024 and saw an 11% growth in gross dollar volume YoY.

- PayPal processed $1.68 trillion of total payment volume across 26.3 billion transactions in 2024, serving 434 million accounts.

- Adyen processed €1,285.9 billion in 2024.

What These Numbers Mean For You

- Profitability is improving fast. More fintech firms are moving past growth-at-all-costs and proving their business models.

- Regulation is speeding up. New rules for instant payments and experiments with digital currencies are prompting companies to rethink their systems.

- Payments are still at the core of it all. Transaction volumes are rising, profits are becoming more steady and digital wallets are changing how people spend.

Fintech Market Trends: Segments Reshaping Finance

Fintech is evolving into a network of specialized sectors, each growing at its own pace and reshaping how financial services are delivered.

What used to be a single wave of disruption is now a collection of focused innovations, including digital banks, lending platforms, insurtech, regtech and AI-driven wealth tools.

Each of these segments is growing fast, building new infrastructure and redefining how people and businesses move, manage and protect their money.

- The global neobanking market was valued at $143.29 billion in 2024 and is expected to reach $3,406.47 billion by 2032.

- According to Statista, there were about 300 million digital banking users worldwide in 2024, led by Europe (100.2 million), North America (69.1 million) and South America (67.4 million).

- The global BNPL market was valued at $19.22 billion in 2024 and is projected to reach $83.36 billion by 2034

- The global robo-advisory market was valued at $8.39 billion in 2024 and is expected to reach $69.32 billion by 2032, growing at 30.3% CAGR.

- In 2024, global insurtech market was valued at $15.56 billion and it’s projected to grow to $96.10 billion by 2032.

- In the U.S., it was valued at approximately $2.29 billion in 2023, with expectations to reach $42.15 billion by 2030.

- The regtech market reached the value of $15.8 billion globally.

- Revolut’s global customer base grew by 38% in 2024 to 52.5 million customers, with group revenue increasing by 72% to $4.0 billion (around £3.1 billion).

- Monzo reported a profit of £113.9 million for the financial year ending March 2025, an eightfold increase compared to the previous year.

What These Numbers Mean For You

- Specialization drives growth. The fintech industry is splitting into various fast-growing areas, like banking, lending, wealth management, insurance technology and regulatory tech, each demanding needs its own unique approach and setup.

- Speed combined with a solid structure is key to success. The fastest-growing sectors are expanding quickly, sometimes doubling or tripling their growth rates. Companies that can execute rapidly while ensuring they comply with regulations and manage risks effectively have a significant advantage.

- Trust is the ultimate differentiator. As fintech becomes more integrated into everyday life, factors like security, compliance with regulations and a smooth user experience are crucial for gaining customer adoption and loyalty.

Real-Time & Instant Payments

Real-time payment systems are transforming how quickly money moves, cutting settlement times from days to seconds and reshaping the flow of funds across economies.

Networks like the RTP network and FedNow Service in the U.S., Pix in Brazil and Unified Payments Interface in India are processing billions of transactions and trillions in value each year.

This fast speed is allowing for new uses, like quick payroll, instant insurance payments, immediate B2B transactions and cross-border money transfers. In the UK, open banking is making it easier for people to access these real-time services.

As consumer and business expectations for immediacy grow, financial institutions are investing heavily in instant payment infrastructure to stay competitive and capture new revenue streams.

- The Real-Time Payments (RTP) network processed 343 million transactions totaling $246 billion in 2024.

- The RTP network increased its transaction cap from $1 million to $10 million, enabling larger real-time transfers. BNY Mellon was the first to make use of this new limit, completing a $10 million RTP payment in February 2025.

- The Federal Reserve’s FedNow Service, its nationwide instant payments network, continued expanding in early 2025 and has now connected more than 1,400 participating financial institutions.

- In the United States, bank-to-bank payments sent through the Automated Clearing House (ACH) network on a same-day basis topped 1.2 billion transactions worth $3.2 trillion in 2024.

- Across the full ACH Network (all timings), 2024 volume reached 33.6 billion payments valued at $86.2 trillion; business-to-business ACH rose to 7.3 billion payments (+11.6% YoY).

- Brazil’s Pix processed R$22.12 trillion in 2024.

- India’s Unified Payments Interface processed 185.8 billion transactions in the fiscal year 2024 – 2025.

- In the UK, 13.3 million people and small businesses used open banking in March 2025, meaning 18.4% of account-holders with online current accounts were “open banking active.”

- In the UK, open banking payments reached 27.2 million in March 2025 among the country’s nine largest banks, known as the CMA9, which were the first mandated to adopt open banking. Including all other participating banks, the total is estimated at around 31 million payments that month.

What These Numbers Mean For You

- Instant is becoming the new standard. Real-time payment rails are rapidly shifting user expectations toward immediacy. Businesses that continue relying on slow settlement cycles risk losing relevance as customers and partners demand instant movement of funds.

- Balance speed with security and scalability. When transactions happen in real time, there’s no time to check for risks afterward, so you have to catch fraud and ensure compliance before any transaction happens. It’s essential to create a strong and secure system that can handle increasing transaction volumes while maintaining complete monitoring.

- Open banking is the gateway to growth. In markets like the United Kingdom, open banking adoption is enabling faster account-to-account (A2A) payments and expanding consumer access to real-time services. Combining open banking APIs with instant rails can reduce costs, improve UX and open new revenue streams.

Digital Wallets, Mobile Payments & Fintech Market Share

Digital wallets are rapidly replacing physical cards during both in-store and online purchases, driven by mobile payments, cross-border volume growth and fintechs expanding product lines.

- Global digital wallet adoption is forecast to grow from 52.6% of the population in 2024 to over two-thirds (around 66 — 70%) by 2029.

- About 5.6 billion people worldwide are expected to adopt digital wallets in the coming years.

- The total value of digital payments worldwide is expected to exceed $33.5 trillion by 2030.

- Alternative payment methods, including digital wallets, local bank transfers and Buy Now, Pay Later (BNPL), are projected to account for 58% of global eCommerce transactions by 2028, driven by the rapid growth of account-to-account (A2A) payments supported by real-time payment networks.

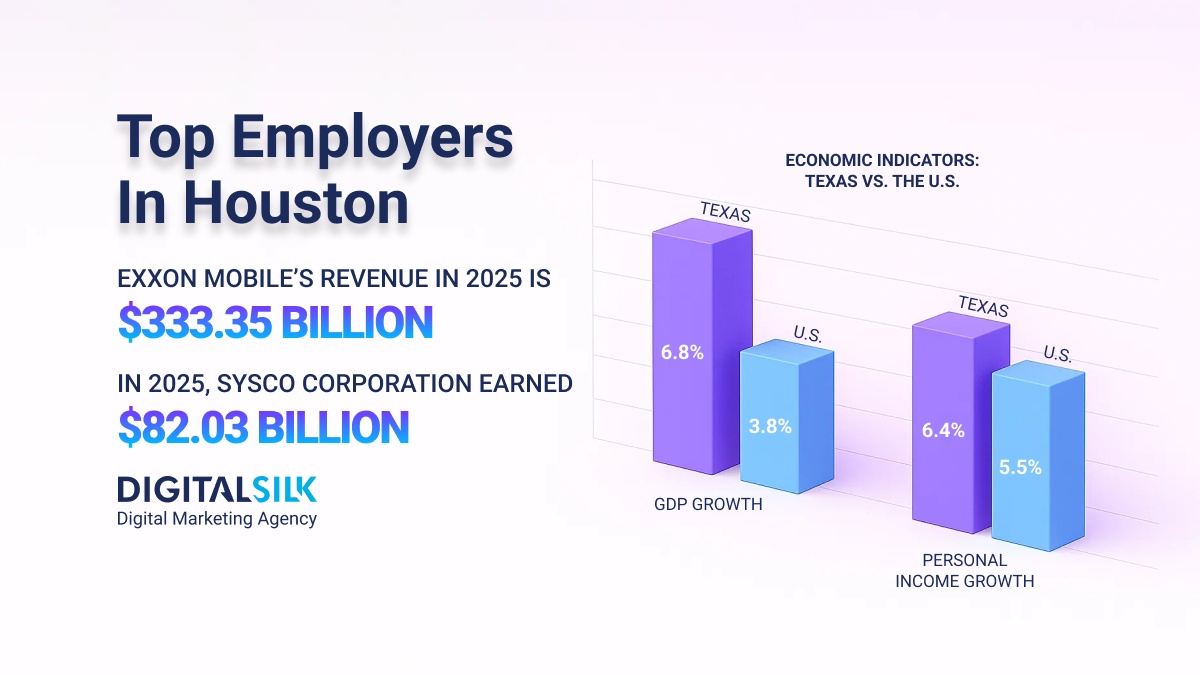

- Mobile wallet (proximity mobile payment) transaction value in the U.S. reached $1.95 trillion in 2024, up 24% YoY.

- Apple Pay is the No. 1 proximity mobile payment platform in the U.S., followed by Starbucks mobile app and Google Pay.

- Apple Pay is now accepted by over 85% of U.S. retailers.

- Google Pay/Wallet reached over 150 million monthly active users globally.

- More than 57 million people used Cash App monthly in December 2024, generating $24.2 billion in annual revenue.

- Wise served 15.6 million active customers and processed £145.2 billion in cross-border transfers in the fiscal year 2025, much of it through mobile wallets.

- Wise also saw cross-border volume growth of 22-24% YoY along with similar growth in active customers.

- Revolut’s total customer balances (deposits + assets) surged 66% in 2024, reaching approximately $38 billion (£30 billion).

What These Numbers Mean For You

- Digital wallets are becoming the dominant payment channel. Platforms like Apple Pay, Google Pay, Cash App and Wise are capturing massive user bases and transaction volumes, pushing mobile-first checkout from a convenience to an expectation. Companies that fail to optimize for wallet-native experiences risk falling behind in both conversion rates and customer loyalty.

- Scale drives profitability in a low-margin environment. Digital wallet and mobile payment growth is surging, but revenue per transaction remains slim. Winning players are those that grow rapidly, expand cross-border capabilities and diversify services around high-volume payment flows.

- Ecosystem integration fuels customer retention. Wallet providers are expanding into deposits, cross-border transfers, savings, credit and investing. Aligning your offerings with these ecosystems or building your own can increase retention and lifetime value.

Mobile Money & Emerging Fintech Markets

Mobile money is transforming how people in developing countries manage their finances. It’s making it easier for millions who don’t have bank accounts to access services like payments, savings, loans and government aid.

In many places, mobile money is becoming the go-to way of handling money.

As more people use these services, they move beyond simple transactions to saving, borrowing and shopping online. This shift is helping small businesses start up, boosting local economies and paving the way for fully digital financial systems.

- Mobile money services processed 108 billion transactions worth $1.68 trillion globally in 2024, up from $1.26 trillion in 2022.

- Latin America & the Caribbean had the highest monthly activity rate among regions in 2024: 32.1% of registered mobile money accounts were active monthly.

- 40% of adults in developing economies used a mobile-money account for saving in 2024, up 5 percentage points since 2021.

- 42% of adults in low- and middle-income economies made or received digital merchant payments in 2024 (either in-store or online), up from 35% in 2021.

- By 2023, there were over 640 million active mobile money accounts globally, with over 330 million in Sub-Saharan Africa alone.

What These Numbers Mean For You

- Mobile money is the new financial backbone in growth markets. What began as an access channel is now the primary financial infrastructure for hundreds of millions, making it critical to design fintech products around high-volume, low-value mobile money rails.

- People are getting more involved with their money than ever before. They’re not just sending and receiving payments; they’re also saving, borrowing and shopping. This change opens up new chances to add features like loyalty rewards, credit options and small savings programs to mobile apps.

- Early-mover advantage is real. With usage exploding across Sub-Saharan Africa, South Asia and Latin America & the Caribbean, fintechs that partner early with local telecoms, banks and governments can secure trusted market positions before competition intensifies.

Risk, Regulation & Consumer Protection

Rapid growth across the fintech sector is triggering stronger oversight on fraud, consumer protection and credit risk worldwide, especially in the United States, where new regulations are reshaping compliance expectations.

Fraud losses are surging even as network defenses tighten and regulators are moving quickly to classify new products like Buy Now, Pay Later as formal credit under Regulation Z.

This marks a shift from “growth at all costs” to “growth with accountability,” where trust, transparency and risk governance are becoming key differentiators for market leaders.

- U.S. consumers reported losing more than $12.5 billion to fraud in 2024; the Federal Trade Commission (FTC) received around 6.5 million total reports in 2024, including about 2.6 million fraud reports.

- Visa blocked $40 billion in attempted fraud in the past 12 months, up from $30 billion the prior year, indicating both increased attack volume and stronger network defenses.

- 96% of U.S. households were banked in 2023; 14.2% were underbanked (≈19.0M households).

- ~63% of U.S. BNPL borrowers had multiple simultaneous loans, and 33% had loans from multiple providers. In May 2024, the Consumer Financial Protection Bureau classified BNPL lenders as credit card providers under Regulation Z, extending dispute and refund protections.

- BNPL users carry heavier unsecured debt burdens and higher credit-card utilization than non-BNPL users (average credit-card utilization 60 — 66% for BNPL users vs 34% for non-users).

- Global remittances were estimated at $905 billion in 2024 (world total), with $685 billion to low- and middle-income countries.

- With 36% of cases in 2024, first-party fraud is now the No. 1 global attack type.

What These Numbers Mean For You

- Trust is becoming a key competitive advantage. As more fraud attempts happen and consumer protections are strengthened, trust will be a major factor for both consumers and regulators when making decisions. Companies that prioritize security, openness and responsible lending are likely to gain more customers.

- Regulatory compliance is a growth requirement. Companies that adopt proactive compliance strategies are likely to grow faster and face fewer regulatory challenges.

- Risk management needs to come earlier in the customer experience. Traditional fraud checks that happen after transactions are too slow for today’s fast-paced fintech industry. It’s becoming crucial to integrate behavioral analytics, identity verification and real-time risk assessments right at the point of interaction to effectively manage risk

AI, Automation & The Next Fintech Leap

Artificial intelligence is rapidly becoming central to fintech innovation, risk management and profitability.

Automation is enabling fintech firms to scale faster, cut costs and personalize user experiences at levels that were previously impossible.

Despite tighter funding conditions, investor appetite for AI-driven fintech models remains strong, signaling that the next wave of competitive differentiation will come from how effectively companies operationalize AI at scale.

- The AI in the fintech market is worth $30 billion in 2025, and it’s expected to rise to $83.1 billion by 2030.

- Generative AI in banking and finance is projected to grow from $1.29 billion in 2024 to $21.57 billion by 2034.

- Global fintech funding in the first half of 2025 was $44.7 billion over 2,216 deals, showing investors are more selective but still deeply interested.

- Adyen surpassed €1 trillion in payments processed in 2024, with revenues rising 23% and EBITDA up 34% year-over-year.

What These Numbers Mean For You

- AI is becoming the core engine of fintech competitiveness. Early adopters are using it to drive fraud prevention, risk analytics and hyper-personalized experiences and those that lag risk losing market share as operational speed becomes a differentiator.

- Generative AI is unlocking new revenue models. Beyond efficiency gains, gen AI is enabling new products in advisory, customer service and credit decisioning. Prioritizing it in your product roadmap can open higher-margin lines of business.

- Responsible AI will define who scales. Regulators and users are demanding explainable, secure AI. Building compliance, governance and transparency into your AI stack from day one will determine whether your innovation can scale sustainably.

Build The Next Era Of Fintech With Digital Silk

Fintech is the infrastructure powering global commerce.

Staying competitive now means combining cutting-edge user experiences with secure, scalable technology and performance-driven marketing.

Digital Silk is a full-service digital marketing agency that partners with fintech brands to design, build and market platforms that accelerate growth while ensuring compliance and trust.

From wallet-first payment UX to enterprise-grade digital ecosystems, we help you scale with confidence.

Explore our relevant services:

- Custom Web Design

- Custom Website Development

- Brand Strategy

- Custom eCommerce Development

- Website maintenance

Contact our team, call us at (800) 206-9413 , or fill in the Request a Quote form below to schedule a consultation and start building the next generation of fintech experiences.

"*" indicates required fields