BNPL Statistics: Key Highlights

-

The BNPL market reached $340 billion globally in 2024 and continues to grow year over year.

-

In 2024, 86.5 million Americans used Buy Now, Pay Later services across retail categories.

-

Shoppers spent $18.2 billion using BNPL during the 2024 holiday season alone.

Flexible payments are quietly rewriting the rules of ecommerce, influencing everything from mobile checkout flow to long-term customer value.

Buy Now, Pay Later (BNPL) has become a key revenue lever for brands looking to increase average order value (AOV), reduce abandonment and retain high-intent shoppers.

The market hit $340 billion in global transaction value in 2024 and is expected to grow at a 12.3% CAGR through 2030, signaling this is more than a passing preference.

In this post we’ll break down BNPL statistics that highlight current market size, emerging customer trends and where the data suggests the model is headed next.

| Insight | Strategic Takeaway |

| BNPL is now an expected payment option across major retail categories. | Brands must integrate BNPL seamlessly in checkout to avoid friction. |

| Millennials and Gen Z are driving repeat BNPL use, reshaping buying behavior. | Demographic targeting should prioritize mobile-first, younger buyers. |

| The U.S. BNPL market will exceed $124B by 2027, with global GMV crossing $1T. | Align BNPL offerings with seasonal campaigns and high-AOV categories. |

| Multi-lender behavior is rising: 63% of users have more than one BNPL loan. | Risk-mitigation strategies should consider overextension and payment defaults. |

| Top providers like PayPal and Klarna are consolidating market dominance. | Provider selection directly impacts reach, reliability and financial exposure. |

Buy Now, Pay Later Market Size & Forecasts

BNPL is shifting from a checkout add-on to a core part of how people shop online.

Its expanding share and user base reflect a broader shift in how payment flexibility is valued at the point of purchase.

The BNPL statistics below point to steady momentum and changing expectations around payment processing.

- The BNPL market share reached 5% of total eCommerce payments worldwide in 2024, rising to 6% in the U.S.

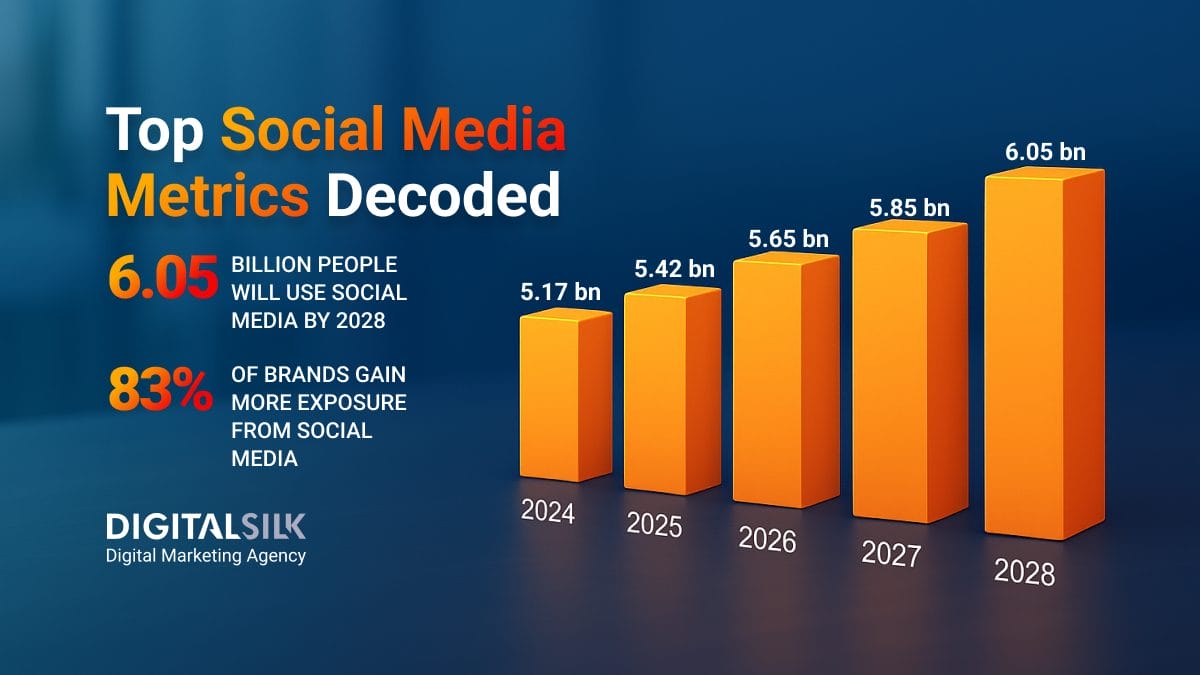

- 86.5 million U.S. consumers used the Buy Now, Pay Later payment services in 2024.

- By 2028, BNPL market growth in the U.S. is expected to see a 4.1% year-on-year increase, reaching approximately 105 million users.

- In 2025, BNPL industry growth in the U.S. is expected to reach 20.4% year-over-year, with total spending climbing to $97.25 billion.

- By 2027, the U.S. Buy Now, Pay Later market is expected to reach $124.82 billion, highlighting the significant growth of BNPL in the coming years.

- Global BNPL growth is expected to continue at a CAGR of 11.4% from 2024 to 2029, with gross merchandise value reaching $1.088.3 billion.

What These Numbers Suggest For You

- BNPL is slowly becoming an eCommerce standard. It has moved from optional to expected, especially at the point of purchase.

- Growth is steady, not spiky. The year-over-year momentum points to long-term behavioral change, not a short-term spike.

- Market share reflects changing buyer priorities. Flexible payment options are increasingly part of how consumers define value and trust.

Buy Now, Pay Later Stats On Customer Demographics

This payment method isn’t defined by a single type of shopper, since it appeals to both financially stable consumers looking for flexibility and those facing short-term financial strain who see it as a necessary option.

The BNPL stats below reveal how age, income, credit health and cultural factors shape adoption, long-term use and engagement rates.

- The majority of BNPL users, or 26.6%, who opted for the service by choice, have an income between $50,000 and $100,000.

- In contrast, 26.9% of users chose BNPL out of necessity, with annual incomes below $50,000.

- 33.6% of Millennials in the U.S. use Buy Now, Pay Later services, followed by Gen Z with 26.4%.

- Pay in 4, a PayPal Pay Later option that allows customers to split purchases into four interest-free payments, is especially popular among younger shoppers — 51% of its users are millennials and Gen Z, while 35% are Gen X.

- Black Americans are the most frequent BNPL users at 25%, with Hispanic Americans using the service at a rate of 21%.

- 18% of shoppers aged 18 – 32 begin their purchasing journey on BNPL marketplaces.

- BNPL adoption in 2024 stood at 15% among women and 12% among men.

- Nearly 30% of adults with credit scores between 620 and 659 used BNPL — roughly three times the rate of those with scores above 720 — and this trend of higher BNPL usage among lower credit score groups is consistent across all age ranges.

- 55% of users choose BNPL because it allows them to afford things they otherwise couldn’t.

- In 2024, 77.7% of BNPL users relied on at least one financial coping strategy, like working extra hours, borrowing money or using savings, compared to 66.1% of non-users.

- 57.9% of BNPL users experienced a significant financial disruption, such as job loss, income reduction or unexpected expenses, compared to 47.9% of non-users.

- Just 37% of BNPL users could comfortably use cash or a credit card to pay in full for an emergency, compared to 53% of non-users who have that capability.

What These Numbers Suggest For You

- Younger generations are leading adoption. Millennials and Gen Z are not just early adopters but repeat users shaping future payment norms.

- Credit health influences usage patterns. BNPL is heavily used by consumers with limited access to traditional credit, making it a tool for financial inclusion and a risk variable.

- Cultural and demographic targeting matters. Usage trends vary by race and gender, signaling opportunities for more tailored messaging and product design.

BNPL Stats On Consumer Preferences & Trends

Consumers are turning to BNPL for more than short-term flexibility, as they’re also drawn to convenience, fee transparency and control over how and when they pay.

Loyalty to specific providers is increasing, but so is multi-lender behavior and simultaneous loan use.

The BNPL stats below reveal how consumer expectations are shaping Buy Now, Pay Later growth across categories and use cases.

- 69% of consumers are willing to use BNPL for future financial services.

- Approximately 63% of borrowers have multiple BNPL loans active at the same time, while 33% use more than one lender.

- 51% of U.S. consumers have never experienced issues with Buy Now, Pay Later services.

- In a BNPL industry report from October 2024, 50% of surveyed Americans were offered a BNPL purchase in the past 30 days, while 10% of users had made a pay later purchase in that period.

- In 2024, 48% of BNPL users said they “definitely will” reuse the same provider.

- 21% of BNPL users fall into the financially healthy category, showing the strongest satisfaction at a score of 731 out of 1000.

- 46% of users prefer BNPL payments due to their convenience and ease of use.

- 42% of respondents used the Buy Now, Pay Later payment services for clothing and fashion, followed by 32% for electronics and gadgets.

- 36% of users turn to BNPL primarily to manage their cash flow and distribute payments over time.

- For 35% of users, protection from interest charges when paying on time is a key factor in adopting or increasing BNPL usage.

- 38% of consumers planned to use pay-later methods for self-gifting during the 2024 holiday season.

- Reflecting that trend, consumers spent $18.2 billion through BNPL over the holidays in 2024, including a record-breaking $991.2 million on Cyber Monday.

- 79.12% of purchases during that time happened via mobile devices.

- 38% of Americans have never used BNPL and don’t expect to use it in the future.

- Users who adopted BNPL saw their purchase likelihood grow from 17% to 26%.

What These Numbers Suggest For You

- Convenience drives loyalty. Users are more likely to return to providers that offer clear terms, simple repayment structures and an easy checkout experience.

- Multi-lender use creates strategic risk. As consumers juggle multiple BNPL accounts, the need for accurate credit assessments and smarter user segmentation grows.

- Seasonal peaks reveal high-intent use cases. Holiday shopping behaviors highlight when and where BNPL can influence spend the most.

BNPL Industry Growth, By Service Provider

BNPL growth is increasingly shaped by the platforms behind it, not just the consumers using it.

PayPal, Klarna, Affirm and others are scaling fast across users, merchants and revenue.

The Buy Now, Pay Later statistics below show how provider performance is redefining reach, influence and competitive positioning.

- At 43.08%, PayPal holds the highest share among payment processing technologies worldwide, covering both payment gateways and BNPL services

- 68.1% of U.S. consumers rely on PayPal’s Buy Now, Pay Later Services.

- 277,534 websites in the U.S. use Klarna as their Buy Now, Pay Later payment method.

- The company reached 100 million active users in the first quarter of 2025.

- At the outset of 2025, Klarna’s revenue stood at $701 million.

- Across the United States, 52,330 online retailers use Afterpay to provide buy now, pay later services.

- Affirm powers BNPL services on 18,532 American websites.

- The provider reported 21.9 million active users at the beginning of 2025.

- Affirm achieved a 36% increase in revenue at the start of 2025, reaching $783 million.

- In the U.S., Sezzle is the BNPL provider for 22,346 online businesses.

What These Numbers Suggest For You

- Provider choice shapes reach. The BNPL partner you select directly impacts how many users and merchants you can access at scale.

- PayPal’s dominance sets the benchmark. Its widespread adoption makes it the default BNPL option for many shoppers, especially in the U.S.

- Smaller players still offer strategic value. Providers like Sezzle can be useful for targeting niche markets or building flexible partnerships.

BNPL Implementation: What It Takes to Get It Right

Integrating Buy Now, Pay Later into your payment stack affects more than your audience’s checkout flow.

It affects return on investment (ROI), compliance and customer journeys in ways that can quietly create risk or drag on margins if overlooked.

- Keep checkout simple and fast: BNPL should sit cleanly within your existing payment flow. If the option adds delays, confusion or redirects, it can increase cart abandonment instead of improving conversion.

- Repayment terms affect your balance sheet: Some BNPL providers delay fund transfers or batch settlements. If your margins are tight or you carry inventory, that lag can create hidden cash flow pressure.

- Risk-sharing terms vary by provider: Certain BNPL platforms offload fraud and missed payments back to the merchant. This isn’t always obvious up front, but it can shift default risk to your side of the ledger.

- Use real-time messaging to frame affordability: Highlight installment pricing alongside total cost to reduce hesitation. Showing “4 payments of $25” next to a $100 product reframes perceived expense and drives higher Average Order Value (AOV

BNPL Challenges Brands Can’t Ignore

BNPL can drive short-term sales, but it also introduces structural risks that affect support costs, fulfillment, brand health and long-term revenue quality.

- Consumers can get overextended fast: When shoppers use multiple BNPL services simultaneously, it becomes challenging to manage repayments. 24% of consumers overspent using BNPL, while 16% failed to make a payment.

- Support teams take the hit when things go wrong: Failed payments, confusing loan terms, and refund issues often land in your customer service channels. If your team isn’t trained for this, resolution times and Net Promoter Scores (NPS) take a hit.

- It can skew your customer base: BNPL tends to attract younger or financially stretched users. That changes your loan-to-value (LTV) profile and increases churn risk if these users can’t sustain repeat purchases.

- Holiday demand creates operational bottlenecks: BNPL usage spikes during peak retail windows. If fulfillment, returns and service don’t scale alongside demand, short-term sales wins can lead to long-term damage.

Build A Smarter BNPL Strategy With Digital Silk

A successful BNPL rollout hinges on clear communication, thoughtful placement and a deep understanding of customer behavior.

Poor execution can lead to confusion, support issues or erosion of brand trust.

Digital Silk helps brands align BNPL with high-impact marketing, cohesive branding, conversion-focused web design and customer retention strategies built for long-term performance.

As a professional digital marketing agency, our services include:

- PPC advertising

- SEO services

- Social media marketing

- Branding services

- Custom web design

For each project, our dedicated experts offer proactive and transparent project management to deliver measurable results.

Contact our team, call us at (800) 206-9413 or fill in the Request a Quote form below to schedule a consultation.

"*" indicates required fields