California Tech Industry: Key Highlights

-

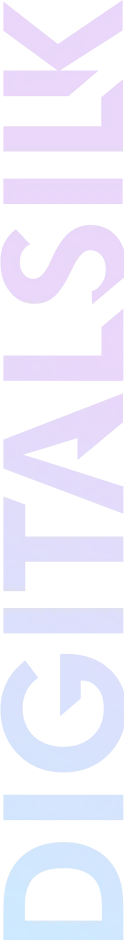

California’s tech sector generates $542.5 billion in direct economic impact, making up 16.7% of the state’s economy.

-

The state is home to over 1.5 million tech workers and 57.504 tech business establishments with payroll operations.

-

Cybercrime cost California more than $2.5 billion in 2024, the highest total of any U.S. state.

California forces its top companies to compete not just on ideas, but on timing, precision and adaptability.

With 10.17% of its workforce in the tech industry, it ranks third nationally for tech talent concentration, setting a high bar for scale and speed.

Growth doesn’t come from following playbooks, but from spotting market shifts early and responding with precision.

In this post, we’ll examine the size, growth and fluctuating trends within the California tech industry and what they point to for those building the next wave.

Technology In California: Size & Workforce Overview

The state has long been the epicenter of technological advancement, attracting top talent, pioneering startups and global giants alike.

Behind that leadership is a fast-moving industry defined by constant innovation and intense competition for skilled professionals.

A closer look at California’s tech industry reveals how technology continues to evolve and shape the broader economy.

- California’s state’s net technology workforce is estimated at just over 1.5 million employees.

- California ranks first in the U.S. with a tech sector generating $542.5 billion in direct economic impact, equal to 16.7% of the state’s economy.

- Tech jobs make up 7.8% of California’s total employment.

- The state is home to 57.504 tech business establishments with payroll operations.

- California ranks first in the U.S. for tech job postings, totaling 320.399.

- From Jan 2020 to early 2024, California added only about 6.000 net tech jobs, causing the state’s share of U.S. tech employment to slip from 19% to 16%.

- In California’s tech workforce, 46.9% are white, 77.8% are between the ages of 25 and 54 and 65.4% are men.

- 76% of U.S. tech leaders acknowledged skill shortages in their departments, while 69% noted that the impact of those gaps has grown over the past year.

- 49% of them identified AI, machine learning and data science as the areas where these gaps are most evident.

- U.S. software developers saw a 2.8% unemployment rate in the first quarter of 2025, compared to systems analysts (1.8%), security analysts (2.3%) and user support specialists (2.5%).

What These Numbers Mean For You

- Rethink growth strategies. Market maturity means expansion now depends more on efficiency, specialization and differentiation than headcount alone.

- Leverage ecosystem partnerships. With so many players in-market, collaboration and alliances can unlock faster scale and competitive edge.

- Treat workforce equity as a business lever. Closing demographic gaps isn’t just ethical, since it strengthens adaptability and leadership credibility.

Tech Area In California: Regional Hubs

The California tech industry is anchored by powerhouse regions where talent density and specialization drive national rankings.

Areas like the Bay Area and Los Angeles stand out not just for the size of their tech workforces, but for their high concentration of software engineers.

The data below reveals how these key hubs compare, how tech employment has shifted post-pandemic and where representation gaps still persist.

- The San Francisco Bay Area holds the top spot in the U.S. for tech talent, with a workforce of 436.740.

- Los Angeles ranks fourth in the nation with 258.640 tech workers, while San Diego holds the 22nd spot with a tech workforce of 80.400.

- The San Francisco Bay Area has the second highest concentration of software engineers working in the tech industry with 75%, coming in second to Seattle’s 78.3%.

- In the Los Angels-Orange County Area, the concentration of software engineers in the tech industry stands at 55.6%.

- In contrast, the U.S. average share of software engineers is 52%.

- In 2024, Silicon Valley’s 20 largest tech companies had more employees in the Bay Area than before the pandemic, despite cutting about 18.800 jobs in 2023.

What These Numbers Mean For You

- Prioritize software-driven growth. High concentrations of engineers make these regions ideal for scaling development teams and launching new technologies.

- Tailor regional strategies to local strengths. Each hub brings unique value and success depends on aligning business goals with localized opportunities.

- Focus high-impact initiatives in key metros. Markets like the Bay Area and Los Angeles offer deep pools of talent and advanced tech infrastructure.

California Economy By Sector: Tech’s Impact

The tech area in California extends well beyond traditional software and IT, fueling critical sectors that anchor the state’s economy.

High-tech manufacturing, logistics, aerospace, clean energy and life sciences all rely on advanced technologies to drive output and employment at a national scale.

This deep integration of tech across industries helps explain why California ranks first in the U.S. for economic impact, workforce size and sector-specific innovation.

- California ranks as the nation’s #1 tech state by economic output, with its high-tech sector generating around $620 billion in value, driven by its concentration of leading global tech companies.

- The state’s high-tech industry employs approximately 371.200 workers and makes up 28.4% of the state’s total manufacturing employment.

- California’s tech-integrated transportation and logistics sector employed approximately 830.000 workers, who handle 40% of all U.S. containerized import cargo and nearly 30% of exports.

- The tech-centric aerospace and defense industry in California fuels $35 billion in annual GDP and employs over 11.000 aerospace engineers, the largest number of any state.

- California employs 145.000 workers in clean electricity generation and storage, more than any other state.

- California is home to 13.600 medtech companies, two of the nation’s top 10 life sciences markets and $60 billion in private life sciences investment.

- The state is the national leader in agtech and farm equipment innovation, with its agtech startups securing around $1.5 billion in venture capital, representing 37% of all U.S. venture funding in the sector.

- The U.S. video game industry consists of five major sectors and over 104,000 employees, 42% of whom are based in California.

- The state’s video game industry produced a total economic output of $26.1 billion.

- California is home to 35 of the world’s top 50 AI companies and contributes a significant share of global AI research.

- With 96.265 complaints in 2024, California ranked first among all states for cybercrime reports.

- Cybercrime resulted in over $2.5 billion in losses for California in 2024, topping the list of all states by total value.

What These Numbers Mean For You

- Prioritize investments in emerging verticals. Growth areas like medtech, agtech and clean energy offer strong returns and align with evolving national priorities.

- Build cross-sector strategies. Opportunities lie in how technologies converge across industries, not just in individual verticals.

- Follow the innovation capital. Venture activity and research leadership in California signal where technology is heading next and where to position for advantage.

Highest Paying Tech Jobs In California

The California tech industry continues to set the bar for competitive compensation, drawing top talent with roles that far exceed national wage averages.

High-level positions often require advanced education and specialized expertise, but the financial rewards can be substantial.

The data below outlines which roles offer the highest pay and how earnings in this industry compare to state and national benchmarks.

- The U.S. median annual wage for Computer and Information Technology occupations is $105.990, significantly higher than the overall median wage of $49.500 across all occupations.

- Among the relevant occupations, Computer and Information Research Scientists earn the highest median annual wage at $140.910, with a master’s degree typically required for entry into the field.

- In California, Computer and Information Systems Managers earn the highest annual mean wage at $232.710.

- Coming in second are Computer and Information Research Scientists, with a median annual wage of $163.890, which is higher than the U.S. average for the same category.

- Average hourly wages across all California industries were $38.15 in Q1 2024, giving context to the state’s high-wage tech ecosystem.

What These Numbers Mean For You

- Target leadership roles that drive innovation. The highest-paid positions are often tied to decision-making and long-term technical vision.

- Leverage California’s premium wage structure to attract elite talent. For companies with a clear mission and strong culture, high compensation can be a competitive advantage.

- Use compensation benchmarks to shape competitive strategy. High salary expectations reflect the value placed on advanced technical roles.

Challenges & Trends in California’s Tech Industry

Despite its status as a global tech hub, California’s innovation economy is facing growing pressure.

The state continues to attract investment and talent, but rising costs, workforce imbalances and new security threats are testing its ability to sustain that leadership.

Some of the key challenges that could threaten California’s tech leadership include:

- Outmigration due to high cost of living: Many tech workers and companies are relocating to states with lower taxes and more affordable housing. This talent drain threatens to redistribute innovation ecosystems beyond California’s borders.

- Skill shortages, especially in AI and data science: 76% of U.S. tech leaders cite critical skills gaps. Demand for AI/ML (Machine Learning) expertise, cybersecurity professionals and data engineers is outpacing supply, stalling growth in key areas.

- Cybercrime surge: The state reported $2.5 billion in cybercrime-related losses in 2024, which is the highest in the nation. California businesses must now invest heavily in cybersecurity infrastructure to safeguard sensitive data and maintain customer trust.

Yet, these headwinds also open new avenues:

- Semiconductor investment resurgence: Public and private sector initiatives are reigniting semiconductor manufacturing in-state, with large facilities planned in the Central Valley.

- Expanding cloud infrastructure and data centers: Tech giants like Google and Amazon are increasing their California-based data operations, bolstering digital resilience and regional job creation.

- Real estate interest driven by AI sectors: Despite outmigration, AI-focused startups are reviving office demand in select corridors, particularly around Stanford and San Jose.

- Navigating global complexity: California’s tech leaders are increasingly called to manage geopolitical risk, regulatory fragmentation and data sovereignty challenges as they scale beyond U.S. borders.

What This Means For You

- Rethink growth strategies: Scale through specialization and tech efficiency rather than pure headcount.

- Form partnerships: Collaborate across California’s innovation hubs to tap into cross-sector strengths.

- Use data to guide workforce equity: Prioritize diversity, inclusion and retention programs to close demographic gaps and increase resilience.

- Future-proof global strategy: Build for localization, not just translation. Anticipate region-specific privacy, trust and compliance frameworks.

- Safeguard innovation assets: Treat IP protection, legal infrastructure and ethical leadership as core strategic pillars, especially in risk-prone international markets.

Forecast: What’s Next For California’s Tech Industry?

With California’s tech industry reaching a point of maturity and global integration, the next wave of innovation will require not just speed, but sustainability, foresight and adaptability.

Businesses can no longer rely on scale alone, as they should also invest in resilience, talent evolution and long-term strategic alignment to remain competitive in a fast-changing digital and regulatory landscape.

- Continued investment in AI and machine learning: Funding for generative AI, Natural Language Processing (NLP) and robotics startups is at an all-time high and shows no signs of slowing.

- Growth in climate tech, medtech and agtech: As sustainability and health become national priorities, California is well-positioned to lead through Research and Development (R&D), talent and capital.

- Realignment of workforce needs: The future calls for hybrid-skilled professionals, who blend technical acumen with business strategy, regulatory insight and ethical design.

- Tighter integration of compliance and innovation: With increasing global scrutiny on AI, privacy and data security, California firms will lead not only in tech but in setting responsible innovation standards.

- Designing for resilience at scale: As firms pursue global expansion, strategic scenario planning, cloud diversification and ethical governance will become non-negotiables.

Grow Your California Tech Brand With Digital Silk

California’s tech industry continues to lead the nation in innovation, scale and cross-sector influence.

For brands looking to compete in this dynamic environment, visibility, positioning and digital performance are critical to long-term success.

Digital Silk helps tech brands in California build signature online identities, create user-centric websites and deploy marketing strategies that drive results.

As a recognized web design agency, our services include:

- Web design for California brands

- Custom web design

- Custom web development

- Branding services

- Digital marketing

For each project, Digital Silk offers proactive management and transparent communication to deliver tangible results.

Contact our team, call us at (800) 206-9413 or fill in the Request a Quote form below to schedule a consultation.

"*" indicates required fields