PPC Competitor Analysis: Key Highlights

-

Not all threats are obvious: Competitors outside your category may still win the clicks your campaigns rely on.

-

Gaps are where the growth is: Uncovered keywords your competitors miss can offer high ROI with less bidding pressure.

-

Segments reveal more than names: Grouping rivals by campaign type shows where the real battles for attention are happening.

Every click in paid search is a contest and the top players are the ones dissecting how competitors set bids, craft ad copy and position their offers.

With search advertising projected to reach $192.1 billion by 2027, the margin for error is narrowing and the ability to outmaneuver rivals is what drives real growth.

The advantage comes from identifying where others are overspending, overlooking or overestimating, then redirecting your investment and messaging to capture that market share.

In this post, we’ll share PPC competitor analysis tips that help you turn competitor blind spots into your advantage.

The Complete PPC Competitor Analysis Checklist

Paid search ads see an average bounce rate of 43.9%, which means nearly half of the clicks often fail to convert into meaningful engagement.

A structured PPC competitor research process helps you understand why rivals win or lose attention, so you can apply those insights to reduce wasted spending and improve campaign performance.

Below, you’ll find the key steps that outline competitor strategies and show where you can gain an advantage:

1. Identify Your Competitors

Before analyzing campaigns or reallocating spend, you need to be certain about who your real competitors are in paid search.

They aren’t always the same players you face in sales conversations and in many cases the businesses winning clicks may not even offer the same product or service.

One way is to manually search your priority keywords on Google and note who appears in the sponsored section.

This will usually reveal a mix of:

- Direct competitors bidding on the same terms for the same audience

- Indirect competitors offering different solutions but targeting the same buyers

- Local competitors competing for geographic visibility

- Seasonal advertisers who appear aggressively around holidays or promotions

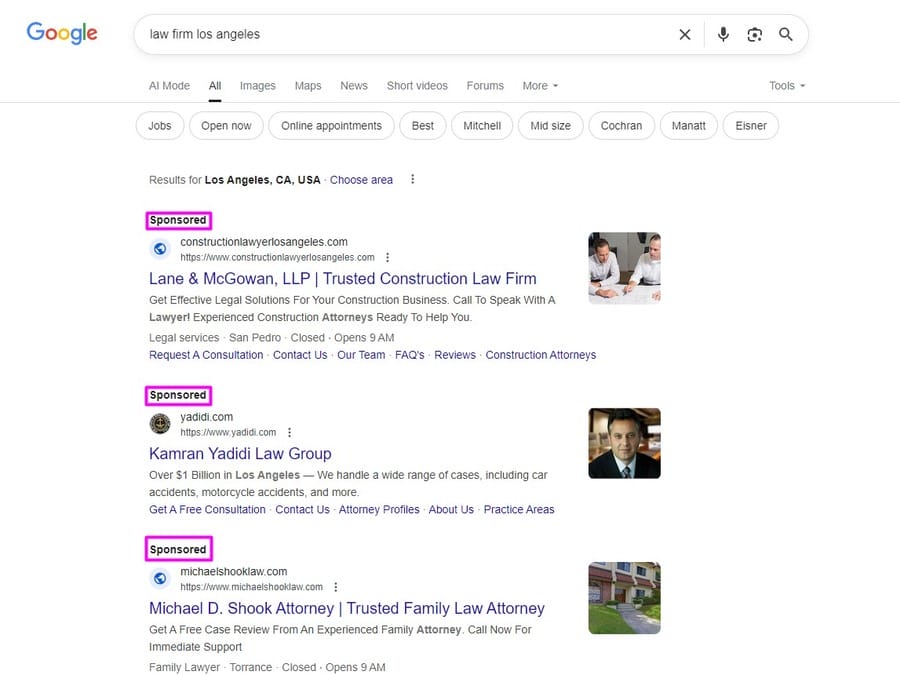

For example, a manual search for “law firm Los Angeles” shows multiple firms competing in the sponsored section, each targeting similar audiences but offering different areas of legal expertise.

This type of snapshot makes it easy to spot direct rivals, unexpected indirect competitors and even local firms that may not appear on your radar until you see them bidding side by side.

To go deeper, tools like Google Ads Auction Insights, SEMrush and SpyFu provide the data that matters most.

Auction insights can show you:

- Impression share, or how often your ads appear compared with competitors

- Overlap rate, the frequency both you and another advertiser appear for the same search

- Position above rate, which highlights how often another advertiser ranks higher when you both appear

- Top of page rate and absolute top of page rate, which indicate who consistently owns the prime placements

- Outranking share, the measure of how often your ads outperform a specific competitor

SEMrush and SpyFu extend the picture further by identifying who is bidding on your keywords, how much they spend, what historical ads they’ve run and which landing pages they use to convert traffic.

These indicators help you:

- Identify dominant competitors across campaigns

- Detect shifts in rival strategy (e.g., increasing bids or launching new campaigns)

- Adjust your own bids, creatives and timing for better auction positioning

For example, if a competitor suddenly increases their overlap and outranking share, it may signal a new push, allowing you to test different ad copy, expand your keyword base or shift budget to higher-converting segments.

2. Build A PPC Competitor Toolkit That Goes Beyond The Basics

Most marketers rely on a narrow toolset, but deeper PPC competitor analysis demands a more diverse, integrated stack that provides insights across ad formats, funnel stages and reporting outputs.

Consider these tools and their unique strengths:

- Ahrefs: Shows how PPC landing pages rank organically, what backlinks they’ve earned and how SEO intersects with paid campaigns.

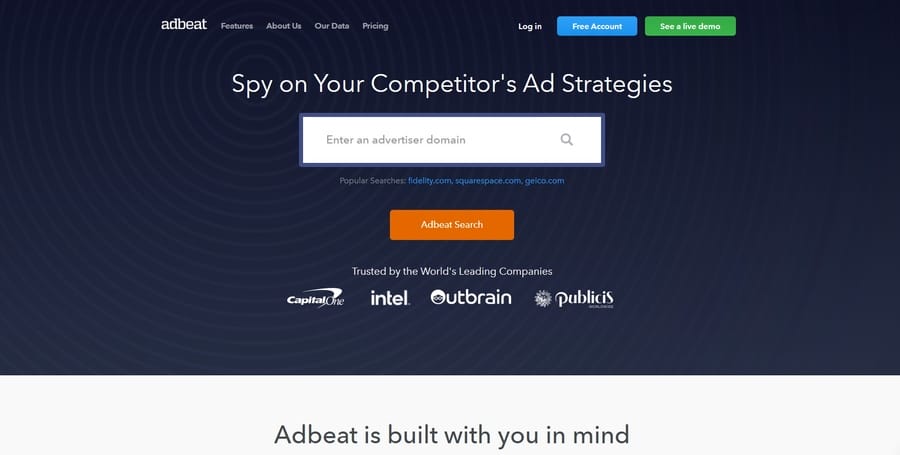

- Adbeat: Offers intelligence on competitor display campaigns, including spend, creatives, placements and frequency, ideal for benchmarking brand awareness efforts.

- Swydo: Translates all of this into automated, client-facing dashboards that visualize data trends, performance comparisons, and actionable insights.

Blending these tools sharpens your analysis across search and display and it also ensures your findings are both strategic and report-ready.

3. Segment Competitors By Campaign Type

A PPC competitor audit is more effective when you stop treating the competition as one large group and instead segment them by the campaigns they prioritize.

Some brands dominate search, others spread spend across display and video, while a few put most of their weight behind branded keywords to defend their name.

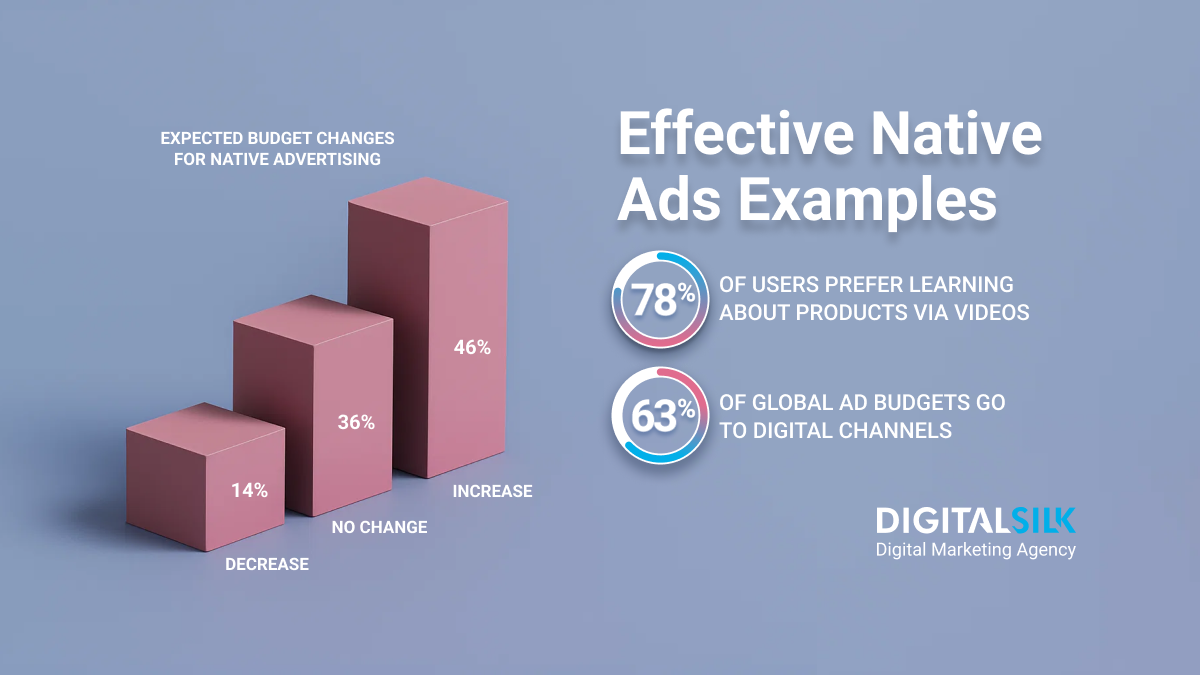

With 72% of marketers using PPC to drive efficient growth, proper segmentation ensures you can see exactly where rivals are investing and which areas may be oversaturated or overlooked.

Breaking competitors down into meaningful categories lets you understand who you are truly fighting for attention in different contexts:

- Brand vs non-brand: Are they protecting their own branded terms, bidding on yours, or chasing broader category searches?

- Search vs display vs video: Which formats do they prioritize, and where are they gaining visibility that you might be underestimating?

- Direct vs indirect: Are they offering the same services, or are they intercepting your audience with alternative solutions?

- Regional or seasonal patterns: Do they appear strongly in certain markets or during specific times of year?

This approach reveals who is driving up your costs, who is drawing clicks away in unexpected places and who may be targeting audiences that are not worth competing for.

By segmenting in this way, you can prioritize resources, defend where it matters and identify the campaign types where you can build an advantage rather than spreading efforts thin.

4. Analyze Competitor Keyword Strategy

Analyzing how competitors approach keywords reveals where they invest heavily and where opportunities remain open.

42% of PPC marketers say they always target exact match keywords, which means many campaigns are narrowly focused and often leave valuable search terms unchallenged.

By studying these patterns, you can see which terms justify continued investment, which are overpriced battlegrounds, and where untapped opportunities exist that can drive more efficient growth.

Key areas to evaluate during your research include:

- High-volume keywords: Spot the terms that bring competitors the most traffic and decide whether the potential return is worth the higher costs

- Niche keywords: Look for low-budget or less obvious terms that rivals are testing, where a modest increase in spend could generate meaningful results

- Keyword gaps: Identify relevant searches your competitors ignore, giving you chances to capture demand without head-to-head bidding wars

- Negative keywords: Track terms that waste competitor budgets without strong intent, then refine your own list to avoid the same pitfalls

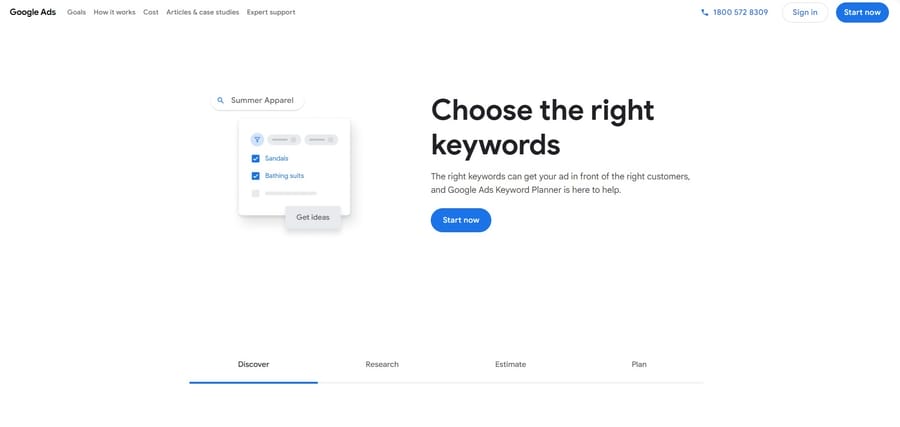

Google Keyword Planner highlights search volumes, competition levels and bid ranges, giving you the context you need to decide whether a keyword is worth pursuing or better left to competitors.

5. Review Target Audience And Funnel Positioning

The way competitors define and reach their audience often reveals more than their keyword list ever will.

A thoughtful PPC competitor strategy digs into who they are chasing and where they try to capture attention along the funnel, from first touch to final conversion.

Some advertisers pour budget into remarketing, staying in front of visitors who left their site without buying, while others aim higher up the funnel with broad campaigns that fill pipelines with new demand.

Examining these patterns helps you understand:

- Which segments competitors prioritize, such as age groups, industries or regions

- How they adapt messaging and creative depending on device or channel

- Where they apply remarketing to re-engage visitors and push them closer to conversion

- Whether their spend skews toward awareness, consideration or direct response

Looking at competitors through this lens makes it easier to see whether they are defending their strongest markets, testing new audiences or reinforcing specific stages of the funnel.

6. Map Competitor Strategy To Funnel Stages

Not all campaigns are created equal and neither are competitors.

Understanding where they allocate budget and how they craft their messaging across the funnel can reveal powerful opportunities.

Study where in the funnel they focus their energy:

- Top-of-Funnel (Awareness): Look for broad keyword targeting, content-focused CTAs like “Learn More” and high-impression ad formats (video, display). This is where brand awareness is built.

- Mid-Funnel (Consideration): Analyze if competitors use case studies, webinars, comparison pages or remarketing. This stage often involves more personalized and educational messaging.

- Bottom-of-Funnel (Conversion): Watch for direct-response CTAs (“Buy Now,” “Get a Quote”), pricing transparency, discount offers or urgency-inducing language. These ads often drive the final decision.

Mapping campaigns by funnel stage reveals where competitors may be over- or under-investing.

For example, if most are crowding the bottom-of-funnel with heavy discounts, you may find more efficient growth by building trust at the consideration stage.

It also helps you better align your own campaigns with the customer journey, improving messaging consistency and boosting conversion rates.

7. Audit Competitor Landing Pages

Dedicated PPC landing pages convert 65% better than standard website pages, which means analyzing how competitors structure and optimize theirs can uncover some of the most valuable PPC competitor insights.

A landing page is often where campaigns either pay off or break down and looking closely at design, copy and user flow gives you signals about where rivals are strong and where they’re leaving openings.

When auditing competitor landing pages, focus on areas such as:

- Page design and user experience: Is the layout intuitive, quick to load and built to guide visitors toward a single action?

- Offers and calls to action: What’s the main incentive they highlight, and how do their calls-to-action (CTAs) compare in visibility and persuasion?

- Message alignment: Does the ad that drives traffic match the promise of the landing page, or is there a disconnect that could frustrate visitors?

- Speed and functionality: How quickly does the page load, and are there technical gaps that create friction?

- Proof and trust signals: Are testimonials, certifications or guarantees being used effectively to build confidence in the decision?

CTAs or seamless user journeys to convert traffic.

It also shows where they might be vulnerable, perhaps their pages load slowly, their messaging is inconsistent or their offers lack urgency.

8. Track Display Ads And Retargeting Strategies

Digital channels made up 72.7% of total advertising spend in 2024, and a large part of that spend goes into display and retargeting designed to keep brands in front of prospects long after the first click.

PPC competitor tracking in this area helps you see how rivals stay visible, how often they pursue past visitors and which formats they rely on to influence decisions.

Even something as simple as visiting a competitor’s site can expose their remarketing strategy, showing you the kind of images, copy and offers they believe will win attention the second or third time around.

When reviewing display and retargeting campaigns, focus on:

- Placement: Which sites or networks feature their ads, and whether they favor premium spots or broad distribution

- Frequency: How persistently their ads follow users, and whether that repetition builds brand recall or risks ad fatigue

- Format: Whether they invest in static banners, interactive units or video, and how consistent the creative is across those formats

- Timing: When their ads appear most often, and if those moments align with high-intent periods in the buyer journey

Tools like Adbeat and Google Display Planner can help uncover these patterns, giving you a clearer view of how competitors allocate spend and where gaps exist in their display and retargeting playbook.

9. Analyze Competitors’ Ad Copy

Ad copy is where strategy becomes visible, showing how competitors frame value, spark attention and persuade action.

In 2024, professionals in North America expected marketing budgets to climb by 70%, which makes wasted impressions more expensive and raises the value of proper PPC competitor benchmarking.

By studying headlines, emotional triggers and ad extensions, you can see the positioning rivals rely on most and where your campaigns can capture ground they’ve left open.

The most revealing signals often come from:

- Messaging: Note headline themes, value propositions, proof points, price or promo framing, risk reducers like guarantees and the exact verbs used in CTAs

- Emotional triggers: Watch for urgency cues, time savings, risk reduction, social proof and authority signals, then record which angles appear most often in winning placements

- Ad extensions: Track sitelinks, callouts, structured snippets, price and call extensions, lead forms and location assets and score how consistently these tie back to the promise in the ad and the landing page

- Seasonal vs evergreen: Log which messages spike around holidays or events, which stay steady all year, how often copy rotates and where competitors go quiet so you can own those windows

Turning these observations into structured tests helps you counter dominant claims with stronger proof points, match extension coverage so you don’t surrender SERP real estate and time campaigns to exploit periods when rivals go silent.

10. Extract Actionable Insights

A PPC competitive analysis guide is only useful if the findings lead to measurable change.

The goal isn’t to copy their tactics but to translate patterns into moves that improve efficiency and open space for growth.

Areas to focus on when distilling insights include:

- What’s working for them: high-performing keywords, consistently used ad themes or landing page structures that drive conversion

- Signs of stagnation: outdated offers, recycled copy or campaigns that fail to adapt to seasonality and shifts in demand

- Opportunities they’ve missed: overlooked keywords, underused ad formats or weak audience targeting that leaves room for you to gain ground

What matters most is converting observation into execution, so every competitive signal you track feeds directly into decisions that raise the impact of your own campaigns.

How To Apply Competitor Insights To Your PPC Campaigns

Once you’ve gathered the insights from your PPC campaign competitor analysis, the next step is putting them into motion.

This is where competitive research turns into real adjustments across keywords, bidding, messaging and targeting that can shift market share and improve efficiency.

1. Refine Your Keyword Selection

Start by folding competitor-backed opportunities into your own keyword set through data-driven and customer-focused campaigns.

Test newly identified terms in smaller ad groups with controlled budgets, then scale those that deliver quality conversions.

Use negative keywords to filter out irrelevant searches competitors may be wasting spend on, keeping your campaigns efficient and targeted.

2. Adjust Bidding Strategy

With 60% of users noticing sponsored ads more often, it pays to be deliberate in how you set bids.

Raise bids on high-intent keywords where competitors consistently drive conversions and use automated bidding rules to stay competitive without overspending.

For terms that are oversaturated, cap your maximum bid and reallocate that budget to more efficient opportunities.

3. Refresh Ad Messaging And Offers

Translate competitor insights into structured ad tests rather than wholesale changes.

Rotate headlines, CTAs and promotions through A/B testing to identify which variations actually move the metrics you care about.

Introduce time-limited offers or refreshed angles during seasonal peaks when competitors recycle the same copy, giving your ads an edge in crowded auctions.

4. Rethink Campaign Targeting

Apply what you’ve learned about audience overlaps to adjust targeting settings directly.

Since Google Ads leads the U.S. market with a 98% share, start there before expanding to platforms like Microsoft Advertising or social channels where competitors may be less aggressive.

Improve location targeting to markets where rivals underperform, refine device bids when you see overinvestment in one channel and test demographic filters that align with profitable segments.

Layer these changes gradually and measure which adjustments deliver results before rolling them out more broadly.

5. Establish An Ongoing Monitoring Process

Build a monthly or quarterly review where you re-run competitor checks and compare against your key performance indicators (KPIs).

Set automated alerts in Google Ads or third-party tools to flag sudden drops in impression share, major bid shifts or new entrants into your auctions.

Treat these signals as prompts for tactical adjustments rather than waiting until performance declines.

Common Mistakes In PPC Competitor Analysis

A paid search competitor analysis can reveal powerful insights, but missteps in interpretation or execution can quickly turn data into wasted ad spending.

The following pitfalls highlight where even experienced teams go wrong and how to avoid slipping into patterns that undermine long-term performance:

- Chasing vanity metrics: Competing to drive down cost-per-click (CPC) or inflate impression share can look impressive on a report but does little for revenue. Prioritize metrics tied to business outcomes like cost per acquisition or pipeline contribution.

- Jumping to conclusions without context: Seeing a competitor outrank you doesn’t always mean their strategy is working. Without understanding their ad spend, targeting or funnel design, it’s risky to copy tactics that may be unprofitable.

- Overreacting to short-term changes: Daily swings in impression share or ad rank are normal and rarely demand immediate action. With 49% of professionals saying PPC management is harder than it was two years ago, the smarter move is to focus on patterns across weeks or months before shifting budgets.

- Ignoring indirect competitors: Rivals outside your immediate category may still bid on the same terms and capture intent you care about. Overlooking these players means missing threats that quietly siphon clicks and conversions.

- Forgetting to validate hypotheses: Borrowing ideas from competitor campaigns without testing them first can backfire. Treat every insight as a starting point for experiments rather than a ready-made solution.

The Benefits Of A PPC Competitor Analysis

Competition in paid search is constant and the brands that thrive are the ones treating every click as insight into how to win the next.

Using a PPC competitor audit can turn what rivals are doing into signals you can use to benchmark, adapt and grow with precision.

Some of the key advantages of this strategy include:

- Sets realistic industry benchmarks: Comparing CTR, CPC and conversion rates against actual competitors shows you where performance is strong and where it’s lagging. This shifts targets from guesswork to evidence-based goals tied to your market.

- Strengthens SEO strategy: PPC keyword gaps often expose opportunities that content teams can claim organically. Using paid insights to inform SEO keeps you ahead in channels where visibility compounds over time.

- Reveals market gaps and unmet needs: When competitors repeatedly target the same segments, it highlights the audiences they’re not addressing. With digital advertising projected to reach 76.8% of total revenue by 2029, the openings you spot now are likely to grow in value as budgets keep shifting online.

- Inspires better creative and copywriting: Seeing which headlines and offers competitors rely on helps you understand what resonates. It also shows where they’ve grown repetitive, giving you space to test fresh messaging that captures attention.

- Enhances cross-channel strategy: Mapping how rivals connect PPC with SEO, social and other channels reveals patterns you can adapt. Coordinating campaigns in the same way ensures that your efforts reinforce each other and move prospects through the funnel more effectively.

Turn Insights Into Impact With Visual Reporting

Competitor data is only as useful as it is communicated. Turning research into clear, visual formats helps you get stakeholder buy-in and keeps your marketing team aligned.

Here are ways to present your findings:

- Heatmaps: Highlight where competitors are bidding heavily, which gaps you can fill, and what terms overlap across the top players.

- Performance Benchmarks: Use bar or line charts to show how your CPC, CTR or conversion rate compares against industry leaders.

- Trend Lines: Visualize how competitor ad copy, spend or positioning have changed over time, especially useful for seasonal campaigns or new launches.

- SERP Visuals: Screenshot top-performing ads to create swipe files or conduct extension/CTA comparisons side-by-side.

Tools like Swydo, Google Looker Studio and AgencyAnalytics allow you to automate these visuals, integrating multiple sources for a comprehensive PPC competitor benchmarking report.

Launch Data-Driven PPC Campaigns With Digital Silk

Studying how competitors advertise shows where the market is shifting and which strategies truly earn attention.

Turning those insights into action helps brands capture overlooked opportunities, improve efficiency and strengthen campaign impact.

At Digital Silk, we transform these findings into data-driven PPC campaigns that raise visibility, drive conversions and position your brand to outperform competitors.

As a recognized digital marketing agency, our services include:

- PPC management

- Digital marketing

- SEO services

- Social media marketing

- Branding services

- Custom web design

Our experts prioritize proactive project management and transparent communication to deliver measurable results for every partnership.

Contact our team, call us at (800) 206-9413 or fill in the Request a Quote form below to schedule a consultation.

"*" indicates required fields