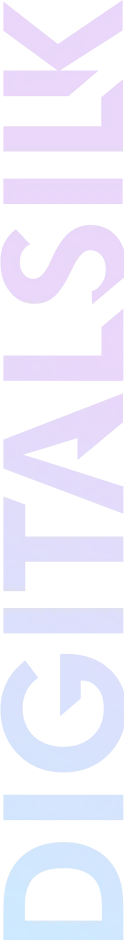

Biotech Companies In New York: Key Highlights

-

NYC life sciences surge: The city’s biotech sector generated $4.9B in gross city product in 2024, nearly doubling since 2014.

-

Major funding flow: Biotech firms attracted $2.4B in venture capital in 2024, cementing NYC as a top U.S. hub.

-

Innovation pipeline: Startups like Lexeo, Volastra and Kallyope are driving breakthroughs in gene therapy, oncology and metabolic diseases.

New York has become one of the strongest life sciences hubs in the U.S., generating $4.9 billion in gross city product in 2024.

It also attracted $2.4 billion in venture capital in 2024, with city initiatives like LifeSci NYC building the talent and infrastructure that keep the sector growing.

For executives, investors and researchers this surge presents both opportunity and risk: partnerships are forming fast and the gap between market leaders and companies falling behind is widening.

This list highlights 25 biotech companies in New York to help you spot collaboration opportunities, benchmark your strategy and assess where to compete or invest next.

25 Best Biotech Companies In New York

These 25 biotech and healthcare companies are driving innovation across New York’s life sciences sector, advancing breakthroughs from early-stage research to large-scale commercialization.

Their work spans next-generation therapeutics, diagnostics and digital health platforms.

Together, they’re shaping how future treatments are discovered, developed and delivered to patients worldwide.

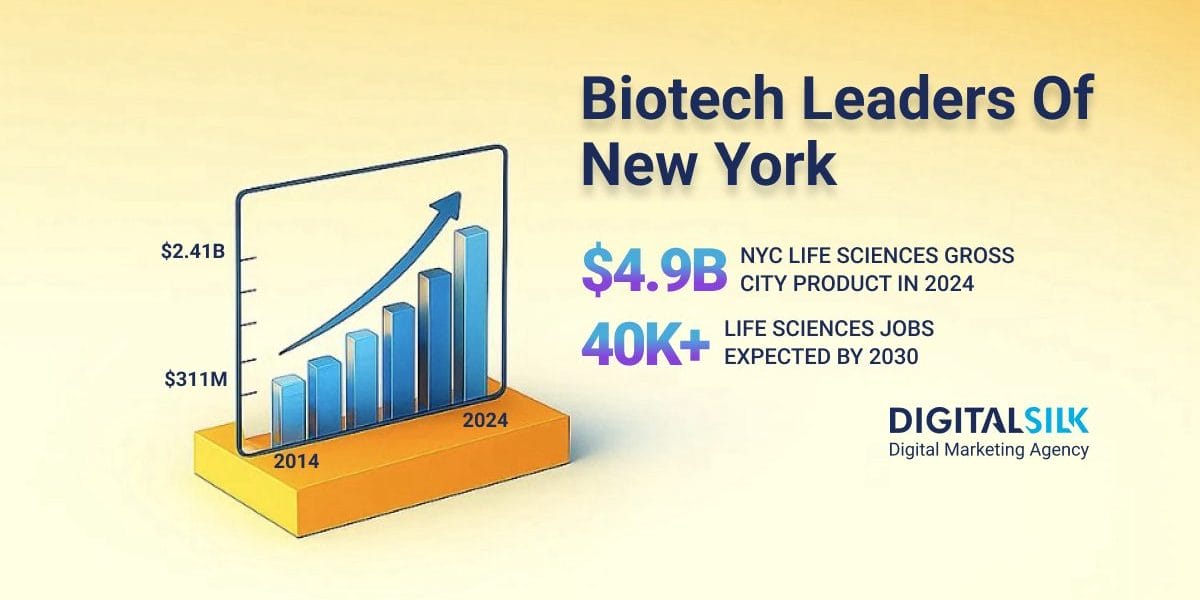

1. Pfizer

- Founded: 1849

- HQ: The Spiral, Hudson Yards, New York, NY

- Core focus: Vaccines, oncology, immunology, rare diseases

- Best for: Late-stage Research and Development (R&D) collaborations, large-scale commercialization

- Notable programs: mRNA platform, Prevnar, Eliquis

Pfizer is one of the most influential biotech companies in New York and a cornerstone of its life sciences sector.

It combines vast internal R&D with global commercial infrastructure, frequently acquiring and partnering with smaller biotechs to accelerate promising programs.

In 2024, Pfizer reported $63.6 billion in revenue despite post-pandemic vaccine normalization.

Its scale and regulatory muscle make it a key exit pathway for emerging biotech startups in NYC.

2. Regeneron

- Founded: 1988

- HQ: Tarrytown, NY

- Core focus: Biologics, immunology, ophthalmology, oncology, genetics

- Best for: Biologics development, genetic target discovery

- Notable programs: Eylea, Dupixent, Regeneron Genetics Center

Regeneron has grown from a local startup into one of the top biotech companies in NY and a global leader in biologics.

It integrates genetics-driven target discovery with in-house biologics manufacturing at an industrial scale.

Regeneron reported $14.2 billion in total revenue for 2024.

Its model shows how New York-based biotechs can stay independent while competing globally.

3. Bristol Myers Squibb

- Founded: 1887

- HQ: Alexandria Center for Life Science, New York, NY

- Core focus: Oncology, hematology, immunology

- Best for: Immuno-oncology trials, late-stage drug launches

- Notable programs: Opdivo, Revlimid, Breyanzi

Bristol Myers Squibb (BMS) combines global commercialization power with deep R&D roots in New York.

It runs pivotal immunotherapy trials from its Manhattan R&D hub, collaborating closely with academic medical centers.

BMS reported $48.3 billion in 2024 revenue, with oncology and hematology continuing to drive growth.

Its executional scale and regulatory expertise make it a preferred partner for NYC biotech companies entering late-stage development.

4. Memorial Sloan Kettering Cancer Center (MSKCC)

- Founded: 1884

- HQ: Upper East Side, New York, NY

- Core focus: Cancer research and care

- Best for: Rapid oncology trial activation, biomarker-rich cohorts

- Notable programs: MSK-led cancer prevention network expansion

MSKCC is one of the world’s leading cancer centers and a central partner for biotech companies in New York running early- and late-phase oncology studies.

The organization combines high-volume specialty care with deep translational research, frequently spinning out startups and co-developing diagnostics and therapeutics with industry.

In 2024, MSKCC reported $8.145 billion in total operating revenues as patient volumes and research activity continued to grow.

MSKCC also gifted $40 million to launch the Marie-Josée Kravis Center for Cancer Immunobiology, expanding its research footprint.

MSK’s NCI Cancer Center Support Grant (NIH record) underscores its role as a national research anchor and a reliable site for activating oncology trials at scale.

5. Intra-Cellular Therapies

- Founded: 2002

- HQ: Columbia University Medical Campus, New York, NY

- Core focus: Neuropsychiatric and neurological disorders

- Best for: Central Nervous System (CNS) drug development and lifecycle expansion

- Notable programs: Caplyta, ITI-1284

Intra-Cellular Therapies has become one of the few NYC biotech companies to build a commercial franchise in CNS, a field notorious for high attrition rates.

Its flagship drug Caplyta for schizophrenia and bipolar depression generated $680.5 million in net product sales in 2024. The company is expanding Caplyta’s label and advancing next-generation psychiatric treatments.

Intra-Cellular Therapies’ trajectory shows how local biotechs can scale despite the challenges of neuropsychiatry.

6. Axsome Therapeutics

- Founded: 2012

- HQ: One World Trade Center, New York, NY

- Core focus: CNS disorders (depression, migraine, narcolepsy)

- Best for: Late-stage CNS collaborations

- Notable programs: Auvelity, Sunosi, Symbravo

Axsome Therapeutics has built one of the fastest-growing CNS portfolios among biotech companies in New York.

It brought multiple therapies from trials to market in under a decade, including Auvelity for depression and Sunosi for narcolepsy.

Axsome reported $385.7 million in net product revenue for 2024, representing an 88% growth year-over-year. Its agility in commercializing CNS drugs makes it a model for future NYC biotech startups.

7. TG Therapeutics

- Founded: 2012

- HQ: Midtown Manhattan, New York, NY

- Core focus: B-cell diseases, multiple sclerosis

- Best for: Neuroimmunology partnerships

- Notable programs: BRIUMVI (MS)

TG Therapeutics develops therapies for autoimmune diseases and has rapidly scaled into commercial operations.

Its multiple sclerosis drug BRIUMVI generated $310 million in U.S. revenue in 2024, showing strong early adoption.

TG continues to invest in new B-cell targeted programs and specialty care infrastructure.

It demonstrates how NYC biotech companies can evolve from niche trials to scaled specialty markets.

8. Zentalis Pharmaceuticals

- Founded: 2014

- HQ: Midtown Manhattan, New York, NY

- Core focus: Oncology (WEE1 inhibition, DNA damage response)

- Best for: Early clinical oncology collaborations

- Notable programs: Azenosertib (WEE1 inhibitor)

Zentalis Pharmaceuticals develops small-molecule therapeutics targeting key cancer pathways.

It partners with leading NYC cancer centers to run combination trials and accelerate patient enrollment.

While still pre-revenue, Zentalis reported $371.1 million in cash and investments at year-end 2024, giving it runway for multiple Phase II studies.

Its strong balance sheet and innovative science make it one of the most promising biotech companies in New York City.

9. Northwell Health / Feinstein Institutes

- Founded: 1995 (Northwell Health), 1999 (Feinstein Institutes)

- HQ: Manhasset, NY

- Core focus: Neuroscience, immunology, clinical research

- Best for: Large integrated health system research partnerships

- Notable programs: Institute of Bioelectronic Medicine, Clinical Trials Office

Northwell Health is New York State’s largest healthcare provider and a major research driver through the Feinstein Institutes.

Its research arm, the Feinstein Institutes for Medical Research, acts as the innovation engine behind Northwell, translating discoveries in genetics, oncology, neuroscience, and immunology into patient care.

The Feinstein Institutes operate around 3,000 clinical research studies across 50 labs and support more than 5,000 researchers and staff.

For biotech companies in New York, Feinstein offers both scale and diversity. It provides the ability to test new therapies across a vast patient population and validate findings quickly in real-world care settings.

By bridging cutting-edge science with one of the country’s largest health systems, Feinstein provides an entry point for startups looking to expand from bench to bedside.

10. Lexeo Therapeutics

- Founded: 2018

- HQ: Flatiron District, New York, NY

- Core focus: Gene therapies for heart and neurological diseases

- Best for: Early-stage rare disease programs

- Notable programs: LX2006 for Friedreich’s ataxia cardiomyopathy

Lexeo Therapeutics is a young biotech company trying to solve some of the toughest rare diseases.

Its lead program, LX2006, targets a form of inherited heart disease that has no approved treatment.

The company has raised $80 million in equity financing in May 2025 and received FDA Breakthrough Therapy for its LX2006 gene therapy for Friedreich ataxia (FA) in July 2025.

Lexeo is still early, but it demonstrates how NYC biotech companies are beginning to tackle conditions that once seemed out of reach.

11. Kallyope

- Founded: 2015

- HQ: Alexandria Center for Life Science, New York, NY

- Core focus: Gut-brain axis for metabolic and neurological disorders

- Best for: Discovery-stage obesity and diabetes programs

- Notable programs: Klarity platform, Novo Nordisk obesity target collaboration

Kallyope is exploring how the gut and brain communicate and how that connection could unlock new ways to treat obesity, diabetes and neurological disorders.

Its Klarity platform combines human genetics, molecular biology and computational tools to discover novel drug targets.

In 2024, Novo Nordisk entered a licensing deal for one of Kallyope’s programs, highlighting its commercial potential.

If Kallyope can translate its discoveries into safe, oral medicines, it could reshape the way metabolic diseases are treated.

12. Volastra Therapeutics

- Founded: 2019

- HQ: West Side,New York, NY

- Core focus: Targeting chromosomal instability in cancer

- Best for: Early-stage oncology collaborations

- Notable programs: VLS-1488 (KIF18A inhibitor)

Volastra Therapeutics is pioneering drugs that exploit chromosomal instability, a hallmark of many aggressive cancers, to selectively kill tumor cells.

The company spun out of Columbia University and has built a proprietary platform around this biology.

In 2025, it presented its first-in-human data at the American Society of Clinical Oncology, a milestone rarely achieved by such a young company.

Volastra Therapeutics is still pre-revenue but well-funded and quickly advancing into mid-stage trials, making it one of NYC’s most promising oncology startups.

13. Ovid Therapeutics

- Founded: 2014

- HQ: Midtown Manhattan, New York, NY

- Core focus: Rare epilepsies and genetic neurological disorders

- Best for: Early clinical CNS programs

- Notable programs: OV888 (KCC2 activator), soticlestat (with Takeda)

Ovid Therapeutics is developing therapies for rare epilepsies and other severe brain disorders.

It combines small-company agility with deep neuroscience expertise from NYC’s leading medical centers.

Ovid ended 2024 with over $53 million in cash and expects its runway to extend into the second half of 2026.

The company is focusing on first-in-class small molecules that could give families options where none exist today.

14. MeiraGTx

- Founded: 2015

- HQ: East River Science Park, New York, NY

- Core focus: Gene therapy for retinal and neurological diseases

- Best for: Full-stack vector development and delivery

- Notable programs: Inherited retinal diseases, Parkinson’s, xerostomia

MeiraGTx builds gene therapies for diseases of the eye, brain and salivary glands, and is one of the few NYC companies that makes its own viral vectors in-house.

This lets it move faster from discovery to clinical testing. In 2024, it reported $33.3 million in service revenue from its vector manufacturing partnership with Johnson & Johnson.

In 2025, MeiraGTx also launched a new joint venture with Hologen AI, called Hologen Neuro AI Ltd, to advance its Parkinson’s program.

The project was recognized by the FDA for its potential to speed development, and MeiraGTx has already received $23 million of the planned $200 million cash investment.

Together with its partnerships, this funding is expected to support the company’s operations well into 2027, underscoring its role as one of New York’s more ambitious gene therapy players.

15. Schrödinger

- Founded: 1990

- HQ: Times Square, New York, NY

- Core focus: Computational drug discovery, oncology

- Best for: In silico discovery partnerships, co-owned pipelines

- Notable programs: Schrödinger platform, internal oncology pipeline

Schrödinger blends AI and physics-based modeling to help pharma and biotech companies discover drugs faster.

It licenses its platform to most of the top 20 global pharmas and develops its own oncology pipeline.

Schrödinger reported $207.5 million in 2024 revenue, $180.4 million from software and $27.2 million from drug discovery milestones.

16. Flatiron Health

- Founded: 2012

- HQ: SoHo, New York, NY

- Core focus: Oncology real-world data and evidence generation

- Best for: External control arms, post-approval studies

- Notable programs: Flatiron EHR, RWE data for regulatory submissions

Flatiron Health organizes de-identified oncology patient data from hospitals and clinics and turns it into usable evidence for drugmakers.

Acquired by Roche in 2018, it now supports dozens of FDA submissions each year.

While it does not report revenue separately, Flatiron has become essential infrastructure for oncology-focused biotech companies in New York.

17. Tempus (NYC operations)

- Founded: 2015

- HQ: Chicago, IL (with major NYC presence)

- Core focus: Data-driven precision medicine and diagnostics

- Best for: Oncology and rare disease data integration

- Notable programs: Acquired Paige in 2025

Tempus specializes in AI and data-driven medicine, with strong operations in New York after acquiring Paige in 2025.

Its technology integrates genomic, clinical, and imaging data to guide treatment decisions.

Tempus raised over $1.5 billion in funding by early 2025 and has become one of the most influential precision medicine platforms in the U.S.

For NYC, Tempus represents the convergence of biotech and data at scale.

18. Paige (Acquired by Tempus in 2025)

- Founded: 2017

- HQ: Times Square, New York, NY

- Core Focus: AI-driven digital pathology, diagnostic augmentation, and biomarker discovery

- Best For: Hospitals, labs and biotechs seeking AI tools to accelerate cancer diagnosis and drug development

- Notable Program: Paige Prostate Detect, the first FDA-cleared AI product in pathology

Paige spun out of Memorial Sloan Kettering Cancer Center to make cancer diagnosis faster and more accurate using AI.

The company built one of the world’s largest datasets of clinically annotated pathology images and pioneered AI models that help pathologists detect and classify cancers, starting with prostate and expanding into breast and skin cancers.

Paige raised approximately $220 million from investors including Johnson & Johnson before being acquired by Tempus in August 2025.

Paige’s innovations are reshaping how hospitals, labs and pharmaceutical companies analyze tissue samples, serving as a foundation for the next wave of AI-driven precision medicine.

19. Oscar Health

- Founded: 2012

- HQ: One Hudson Square, New York, NY

- Core focus: Tech-enabled health insurance

- Best for: Value-based care pilots, digital health partnerships

- Notable programs: Telehealth integration, personalized member platform

Oscar Health is a tech-first health insurer that offers individual, small-group and Medicare Advantage plans.

It also licenses its platform to other insurers.

Oscar reported $9.2 billion in 2024 revenue and returned to profitability that year.

It provides a real-world testing ground for digital health tools linked to actual insurance networks.

20. Zocdoc

- Founded: 2007

- HQ: SoHo, New York, NY

- Core focus: Digital healthcare marketplace

- Best for: Patient recruitment, provider scheduling

- Notable programs: Zocdoc Insurance Checker, Zocdoc for Health Systems

Zocdoc is the largest platform for booking doctor appointments in the U.S.

It helps patients find in-network doctors and lets providers manage scheduling.

While private and not disclosing revenue, Zocdoc handles millions of bookings per month.

Its reach makes it a valuable patient recruitment partner for clinical studies run by NYC biotech companies.

21. Applied DNA Sciences

- Founded: 1983

- HQ: Stony Brook, NY

- Core focus: DNA tagging, PCR diagnostics, synthetic DNA production

- Best for: Supply chain authentication, assay development

- Notable programs: LinearDNA platform

Applied DNA Sciences builds DNA-based tools for supply chain security and diagnostic testing.

It has expanded into PCR diagnostics and makes synthetic DNA for research via its LinearDNA platform.

In Q3 FY2024, it reported $3.49 million in revenue for 2024.

Though small, it supports the supply chain integrity and lab work that larger NYC biotechs depend on.

22. Curia

- Founded: 1991 (as Albany Molecular Research, rebranded 2021)

- HQ: Albany, NY

- Core focus: Contract research, development and manufacturing (CDMO)

- Best for: Biotech manufacturing scale-up

- Notable programs: Global manufacturing network, biologics services

Curia helps biotech and pharmaceutical companies translate laboratory discoveries into medicines that can be tested and sold.

Instead of building their own factories, many startups work with Curia to produce drugs under strict quality standards.

In 2024, the company earned a CDMO Leadership Award for its service quality and announced new investments in its Rensselaer, NY site to expand manufacturing capacity.

It also prepared new production lines for sterile drug products, giving biotechs more options to bring therapies into clinical trials.

With more than 3,000 employees worldwide, Curia remains one of New York State’s anchors for biotech manufacturing.

23. Mount Sinai Health System

- Founded: 1852

- HQ: Upper East Side, New York, NY

- Core focus: Academic medicine, clinical trials, biotech spinouts

- Best for: Translational research, biotech incubation

- Notable programs: Icahn School of Medicine, BioDesign Lab

Mount Sinai combines patient care, medical education and deep research across multiple NYC hospitals.

In FY 2024, Mount Sinai’s academic arm, Icahn School of Medicine, was awarded nearly $490 million in NIH funding distributed across 737 research awards.

That level of funding places it among the higher NIH-funded institutions nationally.

Mount Sinai also won specific NIH grants, such as $4 million in 2024 for dermatology research in Down syndrome.

For biotech companies, that translates into credible research partnerships, access to datasets and the kind of institutional heft needed for bold translational programs.

24. Weill Cornell Medicine

- Founded: 1898

- HQ: Upper East Side, New York, NY

- Core focus: Academic research, biotech partnerships

- Best for: Early discovery and translational collaborations

- Notable programs: Englander Institute for Precision Medicine

Weill Cornell Medicine is a leading research university hospital, conducting cutting-edge work in genomics, precision medicine and biomedical engineering.

It is a frequent source of biotech intellectual property and startup activity. In 2024, Weill Cornell researchers published breakthroughs in gene-editing therapies and cancer immunology.

For biotech companies, Cornell is both a collaborator and a talent pipeline for scientific expertise.

25. The Rockefeller University

- Founded: 1901

- HQ: Upper East Side, New York, NY

- Core focus: Basic biomedical research

- Best for: Early-stage discovery science and biotech spinouts

- Notable programs: Rockefeller’s Technology Transfer Office

Rockefeller University is known for shaping modern biomedical science, with 26 Nobel laureates tied to its faculty and alumni.

Instead of running clinical trials at scale, Rockefeller focuses on discovery, i.e., breakthroughs in biology that often seed the next generation of biotech startups.

While not a biotech company itself, Rockefeller acts as a launchpad. Its labs generate intellectual property, foster spinouts and supply a steady stream of talent that powers New York’s biotech ecosystem.

Why New York Is A Biotech Hub

New York has emerged as one of the fastest-growing biotech centers in the U.S., rivaling Boston and the Bay Area.

The city combines world-class academic institutions like Columbia University, Weill Cornell Medicine and Rockefeller University with powerhouse hospitals such as Memorial Sloan Kettering and Mount Sinai.

Initiatives like LifeSci NYC have injected more than $1 billion into developing lab space, creating over 40,000 jobs in life sciences by 2030.

With access to capital, talent and clinical trial infrastructure, New York offers biotech companies a unique environment to scale from research to commercialization.

The Future Of Biotech In New York

The biotech industry in NYC is poised for accelerated growth. Areas to watch include:

- AI in drug discovery: Platforms like Schrödinger are using computational modeling to cut R&D timelines.

- Cell and gene therapies: New York companies are advancing programs in oncology, rare diseases and CNS disorders.

- Cross-industry convergence: Partnerships between biotech, data science and healthtech firms are expanding.

- Funding outlook: Investor dollars are concentrating in fewer, later-stage deals. Phase II biotech financings rose from about $3.8 million in 2023 to $5.2 million by late 2024, and by mid-2025, disclosed biopharma deal value hit $138B even as transaction counts fell. This is the proof that capital is favoring de-risked clinical assets.

For executives and investors, the next decade in New York biotech promises a mix of disruption, consolidation and global leadership opportunities.

Partner With Digital Silk To Strengthen Your Biotech Brand

New York’s biotech sector is expanding rapidly, and how your company presents itself online often determines whether investors, partners and patients see you as an innovator or overlook you for a competitor.

Digital Silk helps leading biotech and healthcare companies in New York transform that presence into measurable growth and long-term authority.

As a full-service digital marketing agency, we offer:

- Web design and development

- Branding for biotech and healthcare organizations

- SEO and PPC services

- Data-driven strategies tailored to biotech and life sciences

We manage every aspect of the project from start to finish, ensuring transparent communication and measurable results.

Contact our team, call us at (800) 206-9413 or fill in the Request a Quote form below to schedule a consultation.

"*" indicates required fields